As the UK is scheduled for their growth numbers tomorrow, the focus would likely remain on headlines relating to Brexit, the covid-pandemic (with new restrictions expected in France and reportedly being considered for England), and the US news relating to the upcoming election and fiscal stimulus. In terms of today’s calendar, there will be a number of central bank speakers and the publication of the ‘account’ of the ECB’s last policy meeting. Earlier, the UK RICS survey’s house price index increased to the highest level since 2002. Other data include US weekly claims and Chinese Caixin services PMI as well.

BoE Governor Bailey will join ECB Executive Board member Schnabel and others in a panel discussion this morning at the Single Resolution Board’s Annual Conference. The panel discussion would be on the impact of the Covid-19 crisis, but likely from a banking stability perspective. Following that, the ECB’s Hernandez de Cos will make a keynote speech.

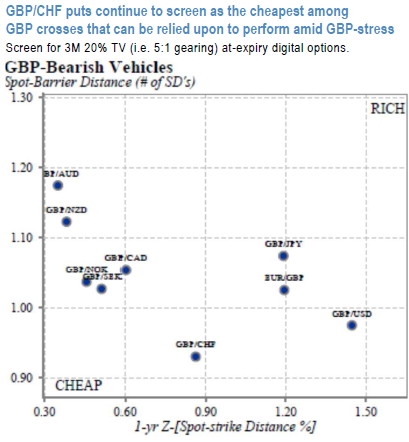

GBPCHF digital puts continue to screen as the cheapest no-deal Brexit hedge within the subset of GBP pairs/ crosses that can be relied upon to consistently deliver in times of GBP stress (refer 1st chart). Recall that in a previous note, we had flagged that high-beta GBP pairs such as GBPUSD, GBPJPY and GBPCHF materially outperform lower beta crosses as weak GBP expressions; EURGBP and other GBP-crosses involving European currencies are ineffective because of the spillover of GBP weakness onto European currencies (ex-CHF). Hence, the focus on this narrow subset of GBP pairs as option-ownership targets; GBPCHF presumably trades cheaper in vol peers in part due to less investor focus on a non-mainstream cross, as well as anecdotal accounts of vol supply from continental private banks via yield enhancement structures. One lens to view the cheapness of GBPCHF vol is via correlations: GBP vs. CHF implied corrs have barely budged from near range highs despite the uncertainty introduced into Brexit negotiations by the Internal Market Bill, which contrasts with the historical experience of swift 20-30 %pt declines in the corr during previous episodes of GBP stress (refer 2nd chart).

Across GBP-crosses, flies are generally cheaper than ATM vols (refer 3rd chart) due to ultra-depressed out-of-the money GBP call vol pricing. GBPCHF flies once again screen as the cheapest of the lot, followed closely by EURGBP, while GBP/commodity FX flies are relatively pricier. At a minimum, this suggests long GBPCHF vol expressions are more efficiently expressed via strangles. For portfolios already well stocked with first order Brexit hedges, there is also a case for owning standalone 3m15D- 20D GBP calls (delta-hedged) that can deliver in a volatile GBP spot rally in the event of an ahead-of expectations breakthrough in UK – EU negotiations 25D EUR calls/GBP puts are expensive relative to other strike/tenor combinations intra-surface and across other GBP pairs.

For a cross that has a track record of underperforming other higher-beta GBP pairs in vol, this overpricing of high strikes is potentially a fade within long/short structures that exploit the cheapness of flies.

For instance, 3M 25D EUR call/GBP put vols are priced near 10-year highs relative to 3M 10D EURGBP strangles (refer 4th chart); selling the former hedged with the latter in equal notionals does require a degree of faith in the eventuality of an 11th hour skinny deal, but is a net theta earning construct with limited maximum loss. Courtesy: JPM

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data