The sterling would remain in focus today, as even much better than anticipated manufacturing PMI data yesterday (actual flash 51.5 versus forecasts at 50.4 and previous at 49.4) and Chancellor Hammond alluding to fiscal stimulus (more details in the autumn statement) couldn't reverse worries of short-term shocks around a hard exit for the U.K. from the European Union.

While the Briton PM May left us with harder questions than answers and is likely to keep her lieutenants tight-lipped for now. The fact that the financial industry will not be a priority in terms of negotiations surprised the market and leaves the pound very much under pressure, with cable today breaking recent lows around 1.2800.

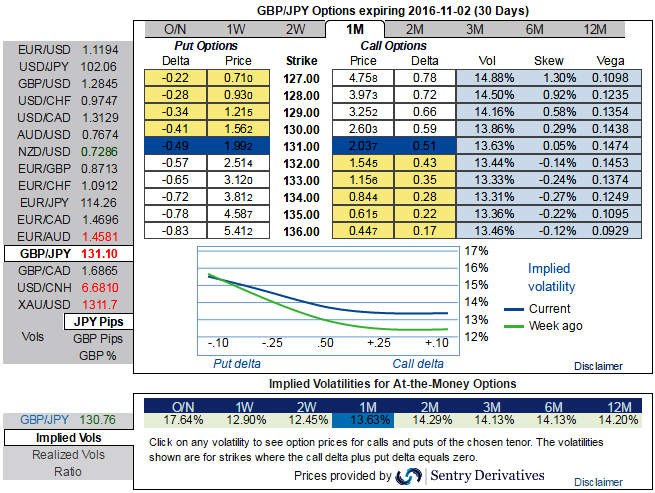

1W and 1M ATM IVs of GBPJPY are spiking more than 12.90% and 13.63% respectively on the back of the above stated fundamental news.

Please be informed that how implied volatilities skews of ATM puts of 1m are positively correlated to the OTM strikes.

In spot FX of GBPJPY, technically the pair has again drifted below EMAs and DMAs to the current 130.794 levels, the article 50 implication are likely to weigh on next BoE monetary policy changes which in turn would have effects on the pound's slumps, but in the short run UK’s recent PMIs in all segments are also indicating conducive business environment.

On the flip side, the chances for lower interest rates in 2016 has grown up, above all lingering post-Brexit formalities adding an extra pressure on sterling's depreciation, the impact of this economic event would more threatening than GBP recoveries.

Hence, we advocate the suitable option strategy to hedge the potential downside risks by using any small bounces through ITM shorts, this would have certainly ensured returns in the form of premiums.

We ponder over arresting potential downside risks of this pair by deploying vega puts in Put Ratio back Spread as you can observe vega with corresponding shift IVs are more luring the hedgers.

So, stay firm with longs on 2 lots of 1M At-The-Money vega puts that would function effectively in higher IV times, long instruments to generate positive cash flows as underlying spot keeps declining.

By now shorts side of 1 lot of 1W (1%) ITM put option would generate assured returns on any abrupt rallies.

The Vega would be at its maximum when the option is at ATM and declines exponentially as the option moves ITM or OTM owing to every tiny shift in IVs that will make no difference on the likelihood of an option far out-of-the-money expiring ITM.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022