Today's high impact economic indicator QoQ preliminary UK GDP numbers that suggest more GBP buying today cannot be ruled out if we get a further rise in growth numbers for the three-month period through May (forecasts remain at 0.7%). The day's principal data focus will likely be the first estimate of UK GDP in 2015 Q2, expected to confirm that the slowdown in economic activity in Q1 was temporary.

But for foreign traders are advised to safeguard their FX exposures through suitable hedging arrangements, we came up with some instances and recommended below strategy. We feel GBP is in good shape but is it good enough to keep our currency exposures in naked positions and confront Yen's uncertainty; this has certainly been a tough call as the implied volatility of this pair is seen at 8.87% which is quite lower side.

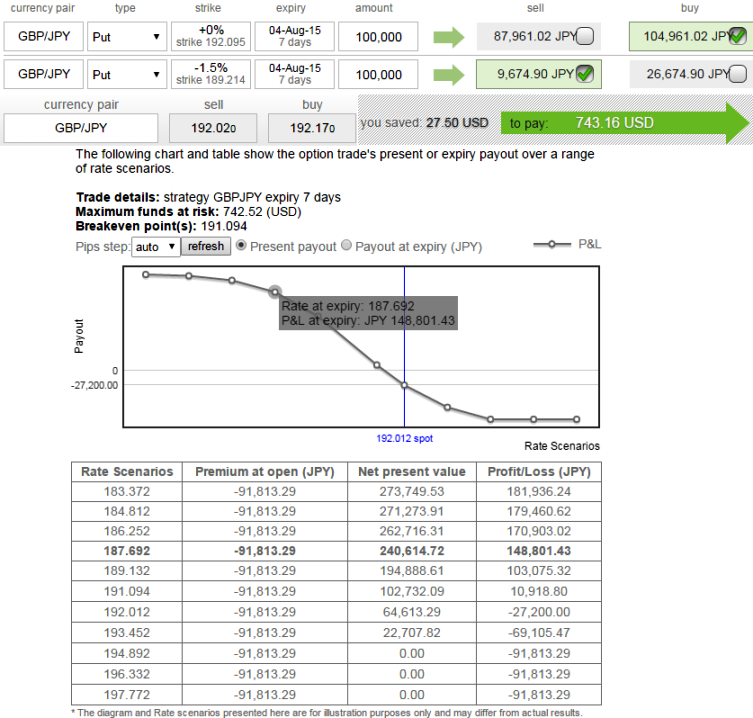

Therefore, in order to participate in uptrend bear put spread shall be used over Protective Put as the premiums on naked puts prove too costlier. Bear Put Spread = Long ATM -0.5 delta Put (192.095) + Sell another -1.5% OTM Put with lower Strike Price (Out of the Money = 189.214) with net delta should be at -0.37.

For a net debit bear put spread reduces the cost of hedge by the premium collected (¥9674.90 on the shorts of OTM put) and keeps hedger to participate on upward moves but it comes at the expense of Partial hedge rather than a complete hedge.

FxWirePro: UK Q2 GDP to post improved numbers; Hedge GBP/JPY with BPS as vols to spike up

Tuesday, July 28, 2015 8:19 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate