The FX market bets on "risk on", as there is a high likelihood that the corona pandemic will not resurge again. At the same time it is equally correct that the FX market is far from trading high-risk currencies such as ZAR at the same levels as before corona. That has nothing to do with a lack of foresight.

On the contrary. Accordingly, we would be very sceptical if the ruble continued its rally. USDRUB exchange rates well below 70 might be appropriate if everyone was vaccinated tomorrow and would resume their pre-corona agenda. But we are a long way off that. Anyone wanting to insure against the risk of a second corona wave (and who doesn’t?!) is therefore likely to avoid the ruble.

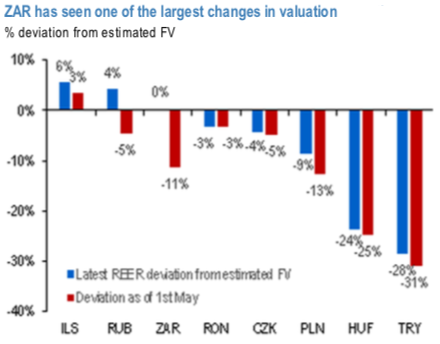

While EMEA EM valuations remain cheap on aggregate, some individual currencies now screen less compelling. Following an initial lag, EM FX has enjoyed a risk-on bounce over the past few weeks with the J.P. Morgan Emerging Market Currency Index (EMCI) up close to 3% since the start of the month. With this, while the simple average deviation from our fair value estimates remains cheap at -7.9%, some valuations (especially in ZAR) have worsened.

In terms of individual currencies, ZAR, RUB and ILS screen expensive, while the remainder remain cheap (refer 1st chart).

We maintain a bearish view on ZAR, with the valuation argument now diminished. Fundamentally, the outlook for the rand remains challenging. The key risks pertain to the manageability of the fiscal situation in a period of low growth, worsened by the COVID-19 shock. We expect funding pressures will prove to be the dominant driver in the period ahead, leading to further ZAR weakness. We had previously acknowledged, however, that cheap valuations could provide some offset to this; however, this is no longer the case. The BEER FV model has moved from a peak undervaluation of -14.4% on 3rd April, to now screening as much as 0.4% expensive (refer 2nd chart). While the absolute size of the overvaluation is small, it will likely provide another headwind against a sustainable rally in ZAR, despite improving global sentiment.

RUB once again screens expensive, but fundamentals remain relatively more attractive. JPM’s BEER FV model points to an overvaluation of 3.6%, which compares to a 5% undervaluation when we entered the OW position on April 2 and to a peak undervaluation of 11.2% on Mar 30 (refer 3rd chart). The marginal overvaluation suggests that, until we see a more substantial rally in oil prices, most of the gains are likely to come on an RV basis. We expect this will likely prove to be the case, with both BoP and fiscal positions comparatively much stronger than other high yielders in EMEA EM, while separately the CBR continues to provide FX reserves support to RUB, with FX sales of around $9.3bn since March 11th.

Considered a RUB – ZAR RV trade, supported by the earlier screener on skews, we wish to uphold the same strategy for now: Sell 3M delta-hedged USDRUB 25D call @10.9/11.3 and hedge it with 3M delta-hedged USDZAR 25D call @16.325/16.725, equal vega. Courtesy: JPM & Commerzbank

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different