The CBRT rhetoric is refining and the lira is depreciating. Claims by Turkish President Recep Tayyip Erdogan that the US is establishing an “army of terror” on the border to Syria are fuelling concerns on the market that the relations between Washington and Ankara could deteriorate further, which is causing the lira to plummet.

Even though towards the end of the year the lira moved away from the highs seen in November (3.98) thanks to the dollar weakness the lira’s recent reaction throws a different light on the Turkish central bank’s (CBRT) rate meeting on Thursday.

Following the disappointing hike in the late liquidity lending rate by only 50bp the market currently expects unchanged interest rates, but the CBRT could quickly come under pressure to act should the lira continue to depreciate at the current rate. We maintain our view that the lira will remain susceptible to bad news due to the low real interest rate level, a fact that was proven to be correct again at the start of the week, and as a result expect rising USDTRY exchange rates over the course of the year.

Additionally, support from local FX selling has now also waned. After selling $10bn of FX between the end of September and end of October, locals have now switched to FX buying adding $5.5bn to holdings since early November.

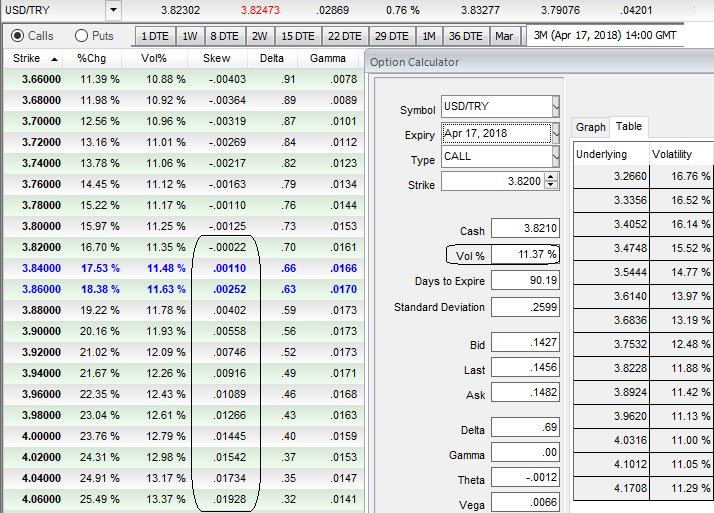

As such the 50bps hike, which still keeps real policy rate negative vs. headline inflation at 13% yoy, is clearly insufficient. It is projected that the further sharp FX weakness to force the central bank into a more credible tightening. While we maintain longs in an outright USDTRY ATM +0.51 delta call (spot reference: 3.8232) of 3m tenors. Please be noted that the IVs of far month tenors are trending higher above 11.37%, while positively skews are indicating hedging sentiments for bullish risks.

You hold this derivative contract on both hedging as well as trading grounds, please observe payoff structure that flies exponentially as the underlying spot FX keeps spiking northwards.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.