The Turkish lira had a volatile session yesterday with USDTRY falling to 3.07 in the morning session first, before turning around to head up to nearly 3.09 by the afternoon. For now, it has bounced back again to the current 3.0967 levels.

This volatility was driven by two recent developments:

First, Kurdish political groups, ranging from part of the HDP parliamentary party itself to terrorist organization PKK, called widely for an all-out resistance movement against the AKP government.

Kurdish groups are now defying emergency rule to stage street protests. This, in turn, was triggered by a recent government offensive which saw two mayors of the largest Kurdish city, Diyarbakir, being arrested.

This was viewed by Kurdish segments as a re-launch of AKP's hostilities towards Kurds. This makes for a volatile domestic political situation which will need to be watched closely day to day.

Secondly, Economy Minister Nihat Zeybekci reminded the media that just because CBT had skipped one rate cut, the monetary easing cycle is not finished. Zeybekci sees ample room for rates to fall from here, and as such, rate easing should be viewed as deferred, not abandoned.

Our own view also has been that, while CBT's last decision sends out a prudent message, it will require cautious behavior over a longer period of time before credibility is established to the extent that the lira can de-couple from vulnerable EM currencies.

We see USDTRY heading back towards 3.20 by the end of the year.

The Turkish lira rallied yesterday after CBT surprised markets by keeping rates on hold at its MPC meeting. But as the pair rallied today, the last week’s gains are almost wiped off when the dollar looked good today again.

Option Strategy:

In the recent past, a credit call spreads with diagonal expiry was advocated and for now, we continue to maintain the same strategy.

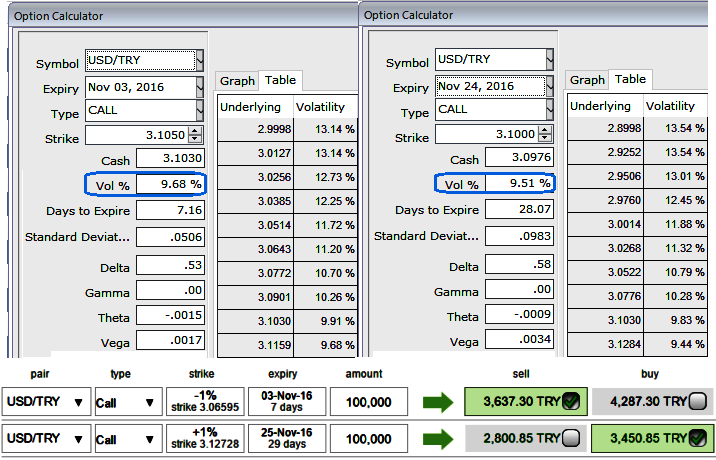

1w ATM IVs of USDTRY is crawling up at 9.68% and shrinking to 9.51% in 1m tenors, we see writers opportunities in overpriced ITM calls.

Thus, as shown in the diagram, it is advisable to initiate Diagonal Credit Call Spread (DCCS) in order to tackle both short-term dips and major uptrend.

Execution: Keeping the above fundamental factors in mind, it is advisable to go long in 1M (1%) OTM 0.36 delta call while writing 1W (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when USDTRY spot FX price is anticipated to drop moderately in the near term and spikes up in long term.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed