Fundamental rationale: On the other hand, we can very much empathize with this NZD's gain slightly at least in short run (let's say next 2 months or so) with an anticipation of Fed may continue to hold on its rate stance until Q1'16 considering global economic slowdown and US job markets. On the flip side, New Zealand consistently posting healthy number of its major exporting contribution which is Fonterra. Those who expect the NZDUSD to make a large move higher, then the below strategy can be established.

It's not changing our stance, before proceeding further please refer previous article for more reading:

http://www.econotimes.com/FxWirePro-Hammer-pattern-on-Kiwi-dollar-likely-to-extend-gains-against-USD-101334

Kiwi dollar after continues losing streak that has begun from mid April, it is now making an attempt of recovery a bit as both technical and fundamental indicators are signaling buying sentiments.

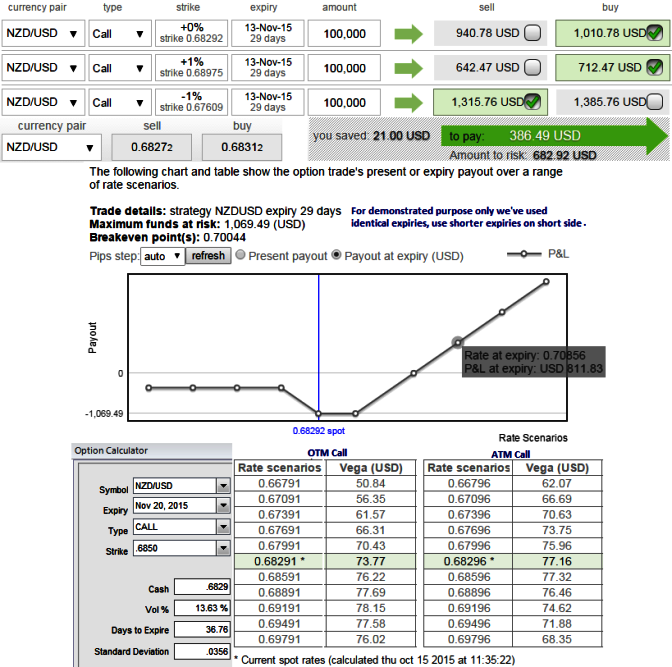

Hence, we recommend it is better to cover all your shorts and as shown in the diagram purchase 1 ATM call and (1%) OTM call and simultaneously short 1 lots of ITM call with shorter expiry in the ratio of 2:1. The lower strike short calls because it finances the purchase of the greater number of long calls (ATM calls are overpriced, so we chose 1% OTM calls as well) and the position is entered for no cost or a net credit.

Vega on Long ATM Call = 77.16

Vega on Long OTM Call = 73.77

The current IV of NZDUSD call is at 13.63% which is quite higher side, usually if the Vega of a long option position is positive and the implied volatility rises or dips, the above stated option prices are directly proportional to the implied volatility.

So in this case Vega both on long position is reasonably acceptable. It is desirable that at maturity the underlying exchange rate of NZDUSD to remain near short strikes in order to achieve highest returns.

FxWirePro: Transform NZD/USD short covering into CRBS – vega on calls to tackle higher IV

Thursday, October 15, 2015 6:49 AM UTC

Editor's Picks

- Market Data

Most Popular