The political parties’ canvassers were eventful in campaigning during last weekend at Rio de Janeiro's Gloria market in a last-ditch effort to persuade spectators to vote for their candidates as general elections are scheduled on 7th October 2018 in Brazil to elect the President, Vice President and the National Congress.

While the modest pricing of the upcoming Brazil elections from earlier in the year has been replaced by viciously bid up election overnights (120vols). It mirrors the results we have had in the local polls (Ibope and Datafolha for example), which suggest that PT candidate Haddad’s momentum has improved and that he seems most likely to face candidate Bolsonaro in the 2nd round on October 28th. ATM vols for the 2nd round have also adjusted and gained an upper hand on 1st round election vols, and as the election remains very uncertain, USDBRL 10/28 overnights may increase to levels last seen in 2018 Mexico election and Brexit referendum.

Fade 1st round vol via outright short gamma and low-cost calendars: With the focus rapidly shifting toward the 2nd round as likelihood of a surprise outcome is quickly evaporating it is tempting to consider a low cost benign outcome BRL topside trades that are able to take advantage of the post 1st round vol roll off. One such construct is a calendar spread.

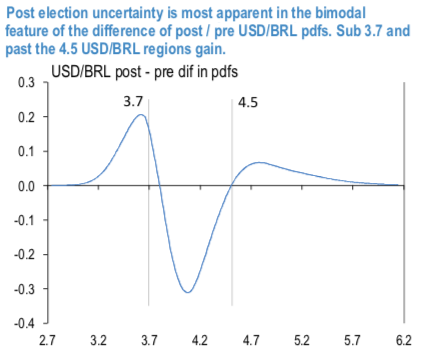

The rationale for utilizing a USDBRL puts calendar rests on the following. Tactical BRL topside is fairly limited as 1st round only clears the lesser hurdle. While the 2nd round is increasingly becoming a coin flip between two candidates which our EM client survey suggests would result in a meaningfully different USDBRL outcomes. The above chart exhibits differential between pre/post 2nd round option implied spot probabilities implying marginal bimodal signature in the post-2nd round USDBRL spot that is clearly seen in the client survey. In a way, USDBRL spot may struggle to make a significant advancement as full-scale uncertainty of the 2nd round continues to weigh.

A vanilla implementation via short 2w 40D USD put/BRL call vs long 4w (expiry before the 2ndround) 40D/20D USD put/BRL call spread costs 35bp USD, a fraction of the premium of buying 4w call spread outright (155bp USD). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 33 levels (which is mildly bullish), while articulating at (12:25 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025