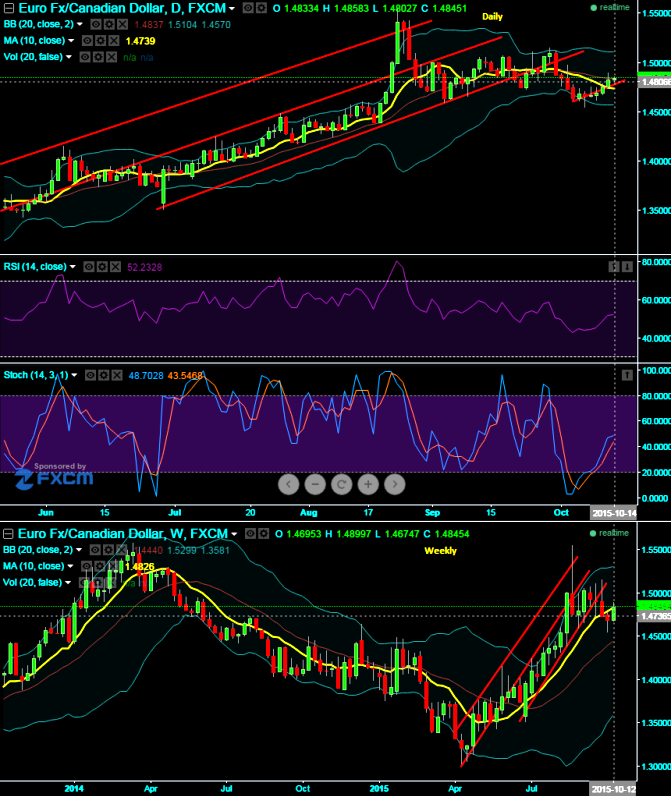

This afternoon slide in EURCAD has stalled on trendline support at 1.4802 levels, once again just below the morning low suggesting that EURCAD is susceptible to another spike higher if it holds this level on closing basis, otherwise it is a clear sell from this level. But on weekly charts, as you can observe s sharp long legged doji exactly at trendline support appeared that signifies more potential on downside.

In our previous write ups we were confident enough to vouch "No twists in EUR/CAD's uptrend", as a result we saw price rallies from 6-7 days.

But for now, it is now the time for raising eyebrow and stay with a cautious approach to deal with pair, so the central idea is simple since intermediary trend has been downtrend but we've been seeing some price recoveries from last couple of days, hence avoid shorting ATM calls and usage of OTM calls are advisable.

Here is the strategy, while holding underlying spot positions, write deep OTM call option + hold an ITM put option (near month Call & mid month put). The original trade view, entitled EURCAD poised for further retreat, was an opportunistic short-term idea that attempted to take advantage of large price swings in volatile markets.

The above strategy yields certainly when the pair either remains sideways or starts dipping down, thereby our shorts on deep OTM calls would fetch certain returns by initial credit received. And thereafter, the time for ITM puts with far month expiry functions.

FxWirePro: Time for cautious approach as EUR/CAD bearish sentiments piling up – collars better options for hedging

Wednesday, October 14, 2015 11:12 AM UTC

Editor's Picks

- Market Data

Most Popular