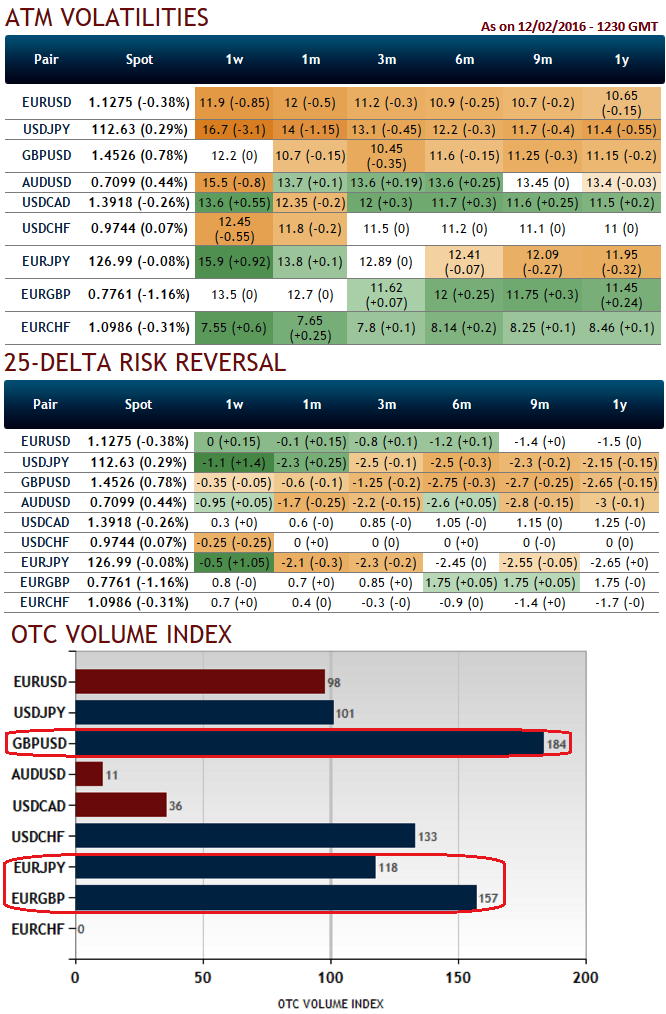

We think that the 18th - 19th February EU Summit will be the next risk event not only for the GBP but for some euro crosses outside euro zone such as EURJPY, EURUSD etc with significant implications for the timing of the EU Referendum. As a result OTC market positions are getting intensified, see IVs for all euro crosses are spiking up including EURCHF.

But this common currency looks stronger against Swiss franc and sterling, however EURGBP is at risk of a pullback in the event of a positive outcome but an impasse at the meeting and consequent "emergency" summit next week should not be discounted.

The 18-19 February EU Summit will be the next risk event for the GBP with implications for the timing of the EU Referendum. While the associated uncertainty is likely to lead to further GBP depreciation versus the USD, the referendum is not only a UK but also a European issue, and we do not anticipate further GBP weakness versus the EUR.

Indeed, we think the markets' recent focus on a higher EURGBP as an expression of referendum risk is misplaced, and we expect a correction lower should an agreement be reached at this week's EU summit, which would lower the perceived risk of a UK exit.

You can make out that from the delta risk reversals table and OTC volume charts, as per these computations, for next 1 month or so, EURGBP and EURCHF are expected to gain the fair amount of yields as vols for these pairs are also indicating considerable rise in OTM prices and so does the OTC volumes adjustments.

But, yen has to hamper major pairs in the weeks to come as on the contrary, we think that the fear of broader global risks now appears to outweigh worries about further BoJ policy easing. As we anticipate EURJPY to break below 125 technically, and concerns on limits of the policy arsenal at the BoJ and rising euro-centric risks, we recommend initiating short EURJPY positions, preferably via options ahead of the March and June ECB meetings, despite acknowledging the recent uptick in the implied volatility of JPY crosses.

FxWirePro: This week EU summit turns euro crosses into high beta - hyperactive OTC arrangements indicate euro 's gains within eurozone

Monday, February 15, 2016 5:31 AM UTC

Editor's Picks

- Market Data

Most Popular