Bearish AUDUSD scenarios see below 0.6650 levels if:

1) China introduces further trade restrictions on Australian exports;

2) Australian authorities commit to longer-term changes to the immigration program, which structurally lower population growth and damage the housing market.

Bullish AUDUSD scenarios see towards 0.70 levels if:

1) China eases fiscal policy more forcefully through the conventional FAI channel, extending the commodity rally;

2) The Australian government commits to replenish cost savings with another round large fiscal easing, shoring up growth prospects and reducing the need for a further policy tweaks from the RBA in coming months.

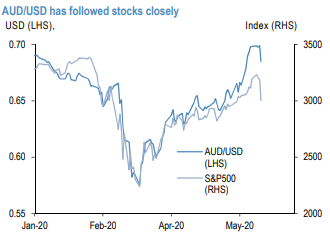

AUD has outperformed our forecasts, tracing the global equity rally (refer 1st chart). We have turned short dollars in the global strategy portfolio, and as a trading view, if the growth rebound remains directionally on track, then AUD will be supported to an extent. Iron ore prices are high, and the Australian economy is advancing out of the activity trough a month or two earlier than expected. Still, we see the more persistent components of the COVID-19 shock as challenging Australia’s medium term growth model more than most other DMs. We raise our near-term targets, but maintain a downward slope to the projections. Q’2020 target is at 0.66 levels (previously 0.65).

Contemplating all these fundamental factors coupled with OTC updates, we advocated some hedging strategies using FX options contracts so as to suit the puzzling swings.

The “Diagonal debit put spread” are more suitable to keep both short-term upside risks and major-trend’s bearish risks on the check.

The execution of strategy: Debit Put Spread = Go long 2M (2%) ITM -0.66 delta put option, simultaneously, short (1.5%) OTM put with lower strike price with net delta should be at 50%00.

The rationale: The delta risk reversal reveals divulge more interests in hedging activities for downside risks (2nd exhibit), while the positively skewed 3m IVs (implied volatilities) also substantiate the same (3rd exhibit). As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair is heading towards 0.6650 or below levels in the medium run amid minor momentary rallies. So, the speculators and hedgers for bearish risks are advised to optimally utilize the deceptive upswings and bid on 1-3m risks reversals.

AUDUSD's higher IV with negative delta risk reversal can be interpreted as opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

For a net debit bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright. Courtesy: Sentry, JPM, & Saxo

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data