With the volatile markets, global trade turbulence, elections and geopolitics, “risk” was one of the key business words of 2018. It is completely normal that the yen eased intraday yesterday and also today. Of course, the flash crash of the exchange rates on Wednesday night would not have been possible without any fundamental justification: “risk-off” in times of increasing economic concerns.

However, episodes like the one we saw yesterday also have the tendency of overshooting. The largest share of overshooting (e.g. USDJPY below 105) was corrected right away, but after that the FX market has to shake itself down a little. What is the residual effect that is acceptable for the average FX market participant?

In the case of marginal exchange rate moves this process happens continuously, in the case of major distortions like the one seen two night ago this takes some time.

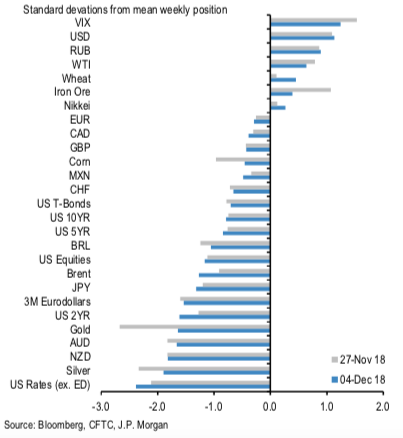

Difference between net spec positions on risky & safe currencies.

Net spec position is calculated in USD across 5 "risky" and 3 "safe" currencies (safe-haven currencies also include Gold).

These positions are then scaled by open interest and we take an average of "risky" and "safe" assets to create two series.

The chart is then simply the difference between the "risky" and "safe" series.

The final series shown in the chart below is demeaned using data since 2006.

The risky currencies are: AUD, NZD, CAD, RUB, MXN and BRL.

The safe currencies are: JPY, CHF and Gold. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -31 levels (which is mildly bearish), while hourly USD spot index was at 37 (mildly bullish), while articulating (at 12:16 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures