Technically, AUD remained in ranging mode, mostly between 0.7747 and 0.7162 in short term.

Remains contained in a consolidative range of 0.7162-0.7874 levels.

For more readings on our recent our technical write up, please visit the below weblink:

AUDUSD in medium term perspective: Lower to 0.7400. The US dollar’s impressive post-election rally may have paused, but still has potential to rise further during the months ahead. As stated in our previous post on technicals, the major downtrend has been sliding through sloping channel but in the recent past it has gone into consolidation pattern (stuck in a range between 0.7874 levels on north & 0.7162 levels on south) but after testing support 0.7162 levels the prevailing upswings may prolong upto channel resistance (refer monthly plotting).

The Fed’s assertive tightening bias plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar.

Moreover, against that coal and iron ore are likely to sustain a good portion of their dramatic rises, and economic data for Q4 and Q1 should improve, but these forces are subservient to the US dollar’s trend. Australia’s AAA rating will remain an issue into the May budget.

OTC updates & option strategy:

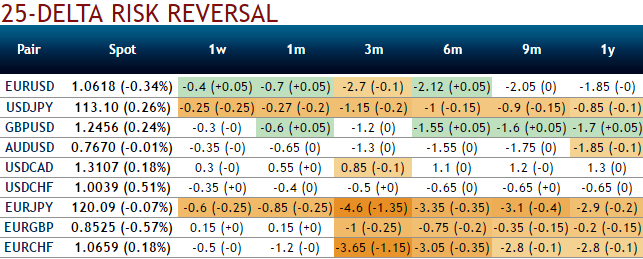

Initiate longs in 2m AUDUSD (0.5%) in the money -0.55 delta put; simultaneously, short 2m (1%) out of the money call at net debit.

Rationale: Let’s glance on sensitivity tool for 1-3m IV skews would signify the interests of OTM put strikes that would mean the ATM calls higher likelihood of expiring in-the-money, so writing overpriced OTM calls would be a smart move to reduce hedging cost.

AUDUSD's higher IVs with bearish-neutral delta risk reversal can be interpreted as an opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Fed Chair Yellen upheld hawkish views in her recent speech, adding that the economy is approaching the Fed's dual mandate of inflation and employment. She further mentioned that the US is near full employment and with inflation figures stabilizing; there is a need for gradual Fed tightening, although she did not mention the exact timing of an interest rate hike.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise