Swiss GDP q/q disappoints by missing forecasts. A dip from previous 0.2% to 0.0% has missed the projections at 0.2%.

While a negative retail sales at -0.8% were way below from previous flashes at 0.2% and projections at 0.4%.

Manufacturing PMI was also no exception to miss out the forecasts, 49.7 vs 50.8 (estimates) vs 50.7 (prev).

It has been a strong uptrend for dollar against Swiss franc for last one month or so, and moreover we believe today's sluggish set of economic numbers are not going to help Swiss franc in any manner.

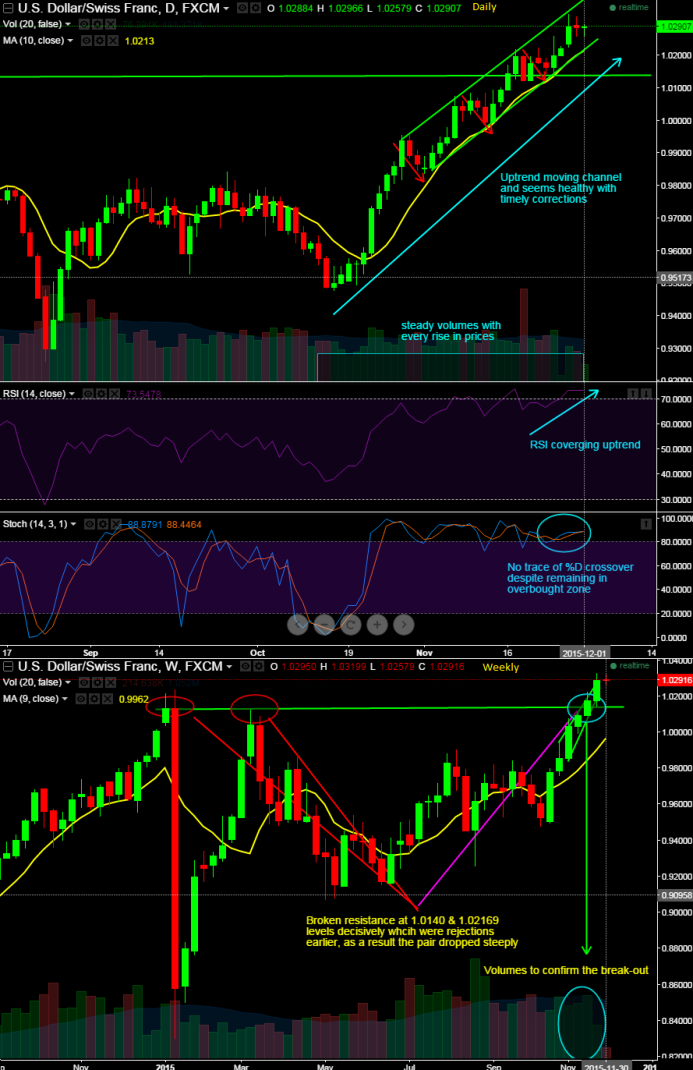

These upswings are in conformity with volumes actions.

Currently, in corrections mood but certainly not below 1.0238 levels.

The spot prices on daily chart have bounced way above 10DMA curve, this would signal us that the prevailing bullish trend to sustain further for some more weeks.

While RSI has been converging these price spikes above overbought territory to lead further uptrend, the current RSI on daily chart is trending at 73.1932.

To confirm this bullish view, slow stochastic curves has approached above 80 levels but no trace of clear %D crossover which is again good signs for bulls.

On weekly time frame, despite the robust bullish sentiments, there has been a tug war between bulls and bears at current juncture, but bears have been well leading the show as there are adverse indications.

Break out crucial resistance at 1.0138 levels sets new stage of bullish sentiments, volumes to confirm these upswings.

However, this disparity could not afford to be interpreted as bearish opportunities. So we still look ahead for buying one touch delta calls at every dips would be the trading idea for the day targets about 30-40 pips.

FxWirePro: Swiss records lackluster economic prints, USD/CHF uptrend remains intact

Tuesday, December 1, 2015 1:19 PM UTC

Editor's Picks

- Market Data

Most Popular