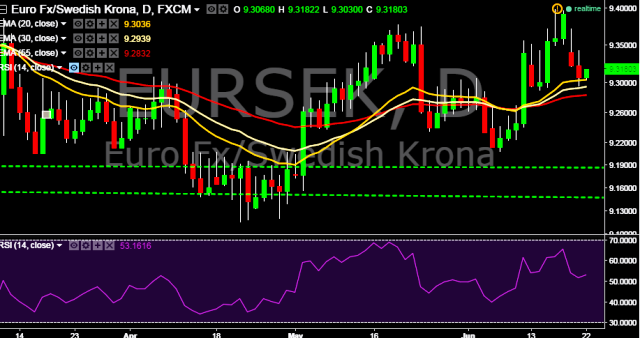

- EUR/SEK is currently trading around 9.3112 levels.

- It made intraday high at 9.3154 and low at 9.3030 levels.

- Intraday bias remains bearish till the time pair holds key resistance at 9.3434 marks.

- A daily close below 9.30 will take the parity down towards key supports at 9.2928, 9.2790 and 9.2582 marks respectively.

- On the other side, a daily close above 9.3434 is required to take the parity higher towards key resistances at 9.3515, 9.3613, 9.3972, 9.4102, 9.4682 (high of February 08, 2016) and 9.4942 marks.

- Sweden will release unemployment rate as well as consumer confidence data at 0730 GMT.

We prefer to take short position in EUR/SEK around 9.3195, stop loss 9.3434 and target 9.2790 marks.