The set of possible ends to the Brexit drama seems to have become smaller last night. Whereas before there were three elements: (“deal“, “no deal“, “no Brexit“) only the options starting in “no” seem to be left now. Of course “no deal” (i.e. a disorderly UK exit from the EU) is the less likely of these two possibilities. The only thing is: this likelihood has risen as a result of the House of Commons vote yesterday. Let us quickly glance roughly in our heads: “deal“ and “no Brexit“ would both be GBP positive, “no deal“ would be GBP negative.

The likelihood the FX market had previously allocated to “deal” now has to be distributed amongst the remaining two alternatives. Regardless of how one looks at it, the likelihood of the GBP negative scenario cannot have fallen and is likely to have risen to a smaller or larger extent.

GBP OTC outlook:

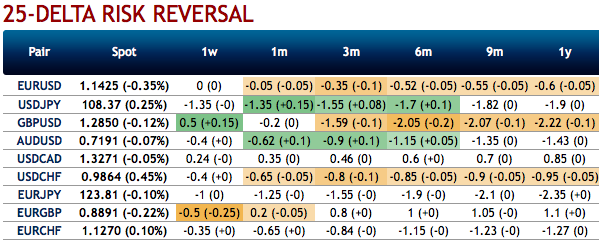

The positive bids in the shorter tenors have been observed to the bearish risk reversal atmosphere in the GBP OTC markets, this is interpreted as the hedgers are keen on bullish risks in the short-run, whereas the long-term bearish outlook still remains intact.

You could easily make out that the positively skewed IVs of GBP have been stretched out on the downside. Mounting bidding for OTM puts is interpreted as the hedgers’ interests for the downside risks.

To substantiate this downside risk sentiment, risk reversals have also been bearish.

We reckon that the sterling should not suffer like before, as the market has always ignored the fact that all the current BoE interest rate moves are due to a favorable result of the Brexit process. One should not disregard the Fed’s hiking cycle on the other hand.

So what is happening with the underlying GBP exchange rates? Well, don’t we all know that the FX market is very bad at pricing in political risks? Following the US Presidential elections in 2016, the dollar initially appreciated considerably – as if this US President would be capable of doing anything USD positive. It took months until the market had corrected this misjudgment. And after all, it took at hours until Sterling came under pressure following the 2016 Brexit referendum. So in that way, yesterday’s market move is an ideal opportunity for all those who want to reduce their GBP positions in view of the no-deal risks.

Hence, it is wise to capitalize on ongoing rallies and bid 1w/3m OTC indications to deploy theta shorts in short run (1m IVs) and 3m risks reversals to optimally utilize for delta longs. Courtesy: Sentrix, Saxo and Commerzbank

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 133 levels (which is bullish), and hourly USD spot index trending at 28 (mildly bullish) while articulating (at 13:34 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields