We have been recommending shorts in GBP since early April as a core part of our overall defensive strategy. The bearish view has been motivated by multiple fundamental factors—ongoing Brexit ramifications, an already-large current account deficit and now a substantially larger fiscal deficit as well. Focus is now increasingly going to be on the possible extension of the transition period which under the terms of the Withdrawal Treaty has to be decided on by the end of June. The COVID-19 outbreak has resulted in obvious delays in the discussions and has had large economic ramifications, which is why our economists now think that a 1-year extension (to the end of 2021) has become increasingly likely (Brexit: the June flashpoint looms). While the EU is open to such an extension, recent news reports suggest that the UK government has pushed back against it.

The economists note that UK’s stance raises the odds that we enter July with no extension in place which would make for a messy outcome and at an extreme, could raise the possibility of a “no-deal”. Immediate attention will be on the May 11th second round of talks between UK-EU negotiations. The BoE next week will get some attention as well as we expect it to increase its QE programme by 50% or £100bn. This would take announced UK QE to a table-topping 13.5% of GDP. As set-out in the Outlook, GBP faces stiff headwinds from the combination of excessive QE, eye-popping fiscal issuance, and a large current account deficit.

Trade tips: Stay short in GBPUSD 1.227 levels via optionality, at the beginning of April. Marked at -2.06%.

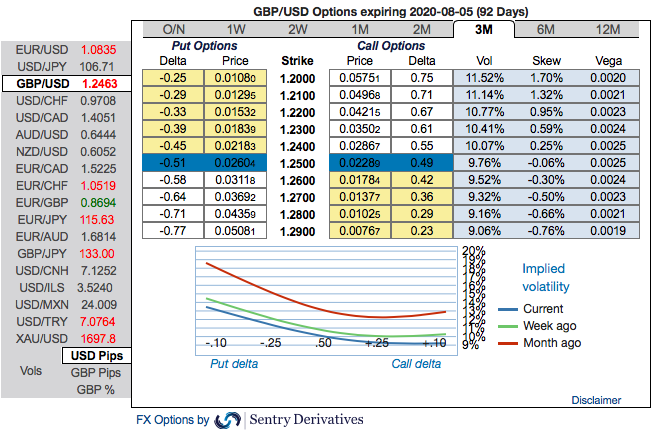

The rationale: GBP will likely take its directional cue from the read-through to BoE’s rate cut whereas the size of the move will be augmented or moderated by the government’s broader policy platform, this is factored-in GBP’s FX options market.

Please observe 3m GBP skews that has stretched towards negative territory, hedgers have shown interests for bearish risks as you could see more bids for OTM Put strikes up to 1.20.

To substantiate the downside risk sentiment, fresh bids in risk reversal numbers have still been signalling bearish hedging sentiments in the long run. Accordingly, we advocate the diagonal options strategy on both hedging and trading grounds.

Though the underlying spot FX is showing some resistance to the prevailing bearish streaks, these rallies seem to be momentary. Hence, this is right time to write deep OTM put options.

Execution of strategy (Debit Put Spread): Capitalizing on the above factors, it is prudent to deploy diagonal options strategy by adding short sterling via a limited loss tail hedge: Stay short a 1M/2W GBPUSD put spread (1.20/1.2850), spot reference: 1.2460 level.

Alternatively, activate shorts in GBPUSD futures contracts of May’20 deliveries with an objective of arresting potential slumps. Courtesy: JPM, Sentry & Saxo

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand