The pound has accelerated higher overnight – extending the recovery after setting new 3-year lows at the beginning of this month, now up 5%. The move triggered by comments from outgoing EU Commission President Juncker (his term finishes on 31st October) commented that a no-deal Brexit would have “catastrophic consequences”, that he was doing “everything to get a deal” and "if the objectives are met, all of them, then we don't need the backstop". While the comments continue to fuel optimism, there is still a long way to go and it would only take a negative comment to knock the pound back in the current less liquid environment.

Elsewhere, the Supreme Court finished hearing evidence on the legality of the Government’s decision to prorogue Parliament yesterday. Reports suggest that it may not deliver its ruling until early next week.

Like most mortals, we have no insight on how the long-running Brexit drama will resolve. All we can say with a degree of confidence is that should the UK crash out of the EU without a deal, the currency markets stand a good chance of directionally reprising the price patterns observed in the aftermath of the 2016 referendum.

EURUSD dropped 1.5% in the 3-months following the shock result and a more substantial 8% in 6-months; EURGBP climbed north of 10% over this period, much of it on the day of the vote; and the realized correlation between the two fell to as low as -90%.

Yet EURUSD vs EURGBP 3M implied correlation today is marked at +14%, Euro has an independent bearish catalyst at play in the form of potentially ECB easing including QE in September and the pricing of bearish Euro options is sweetened by multi-year highs in the forward points.

Consider the following as no-deal Brexit trade: 3M (EURUSD < 1% OTMS, EURGBP > 2% OTMS) costs 11% (individual digitals 26% and 34.7% respectively).

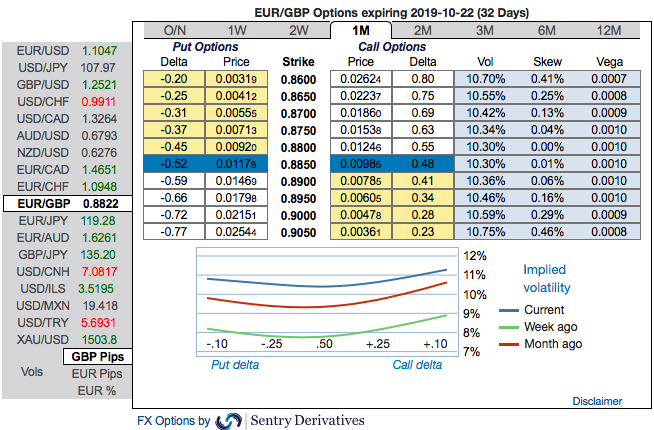

Let’s now quickly glance at OTC outlook before looking at the options strategies. Bullish neutral risk reversals of EURGBP have been observed to the broader bullish risk outlook in the FX OTC markets, this is interpreted as the hedgers are still keen on bullish risks but with mild downside risk sentiment in the near-term (refer to negative risk reversals in 1m tenors which is absolutely in line with our forecasts).

While the IVs of 1m tenors are stretched on either side, this is indicating both upside and downside risks, more bids are observed for OTM calls than OTM puts.

While EURGBP risk reversals of the existing bullish setup remain intact with the mild bearish shift, even if you see minor negative risk reversal numbers, it should not be perceived as the bearish scenario changer. Instead, below options strategy could be deployed amid such topsy-turvy outlook.

According to the OTC FX surface, 3-way options straddle versus ITM calls are advocated seem to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

Options Strategy: The strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 2m tenors, simultaneously, short (1%) ITM puts of 1w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks.

Alternatively, on hedging grounds we advocated initiating directional hedges that comprised of shorts in EURGBP futures contracts of September’19 delivery and simultaneously, the longs in futures of December’19 delivery for the major uptrend, we wish to maintain these positions.Courtesy: Sentrix, Saxo & Commerzbank

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges