The resignation of President Zuma, a solid 2018 budget, and the expected cabinet reshuffle over the weekend mean ZAR can stay “stronger for longer”. USDZAR appreciated a further 4.6% since January as the sustained sentiment boost brought along strong foreign inflows into local markets. The question remains on how long it will take for ZAR to correct back to fair value. The strong momentum and potential for real money investors to rebuild long SAGB positions suggest a trigger for a correction remains absent. We would argue we are probably 70-80% done with the positioning rebuild.

The new South African President Cyril Ramaphosa completed another tight-rope walk with the cabinet reshuffle he presented late Monday evening. The appointments made for key roles underline that tidying up and consolidating the public finances as well as state-owned companies is a top priority.

Yesterday afternoon news that the government had principally agreed to the expropriation of land without compensation caused the currency to record losses though. Together with Moody’s imminent rating decision, this means that there is now less scope for further rand appreciation. Despite the improved outlook for politics and consolidation, the risk of a downgrade is not completely off the agenda.

While rates positioning already shows as high, we still see some positioning scope on lower FX hedging behavior. Overall we would guess we are 70-80% with the positioning build up. The recent client survey shows that investors extended their overweight rates positions for a third consecutive month in February. Long SAGB positions are now largest overweight in EMEA EM, recently replacing long OFZ positions (refer 2nd chart).

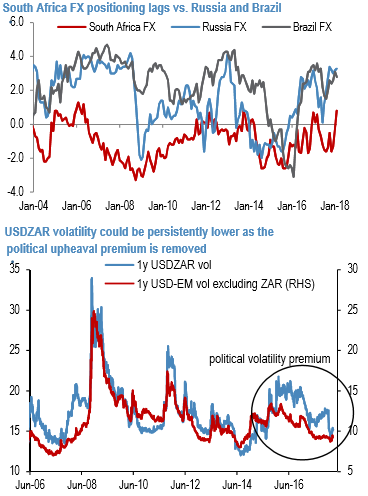

However, compared to Brazil, which also underwent a period of political change, there is perhaps some further room to extend overweight rates positions. Importantly, FX positioning lags substantially vs. Russia or Brazil (refer 1st chart). This is indicative of traditionally higher FX hedge ratios on real money holdings in South Africa compared to other markets. However, this could now also change to some extent:

We believe there is a case for sustainably lower FX volatility as the political risk premium embedded in ZAR since 2015 fades (1st chart). Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?