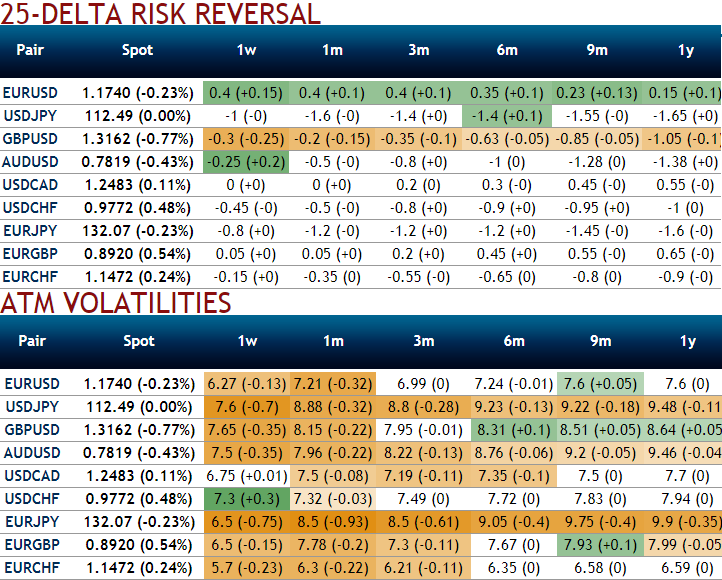

Please be noted that the nutshell evidencing implied volatilities of EURUSD are shrinking away (the least among G7 FX space) while mounting positive risk reversal numbers indicate bullish risks in the long run amid minor obstacles.

Accordingly, we reckon that it wise to capitalize on these lower volatile conditions to deploy the OTM and ATM call option writing during the bearish scenario in the short run.

Getting leverage despite a slower market timing, the EURUSD appreciation is now going to be slower than it has recently been, and the skew is still undecided whether volatility should rise on the back of a higher or lower spot. As such, we do not focus on intermediary vega gains to favor instead a buy-and-hold structure benefiting from the passage of time, as the timing of euro upside is less certain.

The EURUSD appreciation has reached newer highs, those who’ve been dubious for further gains and thinks that pace is now going to be slower than it has recently been, the below options strategy has already been advocated.

The skew is still undecided whether volatility should rise on the back of a higher or lower spot.

As such, we do not focus on intermediary Vega gains to favor instead a buy-and-hold structure benefiting from the passage of time, as the timing of euro upside is less certain.

Mechanics: Buy EURUSD 3m ladder, strikes 1.15/1.20/1.23 indicative offer: 0.35% (vs 1.15% for the call ATM strike only, spot ref: 1.1694).

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025