Angela Merkel is stepping down as leader of the Christian Democrats. That is putting pressure on the euro. However, she is planning to remain chancellor until the end of her term. As a result, the euro retraced its losses, as the market does not tend to look beyond a horizon of two years, as after that the uncertainty becomes too high. And for the next two years everything is likely to remain the same in Germany. The immediate challenges – the row about the Italian budget and next year’s Brexit – will be tackled by the euro zone with Merkel at the helm, which reassured euro traders.

On the flip side, the British Chancellor of the Exchequer Philip Hammond risked a remarkable feat with yesterday’s budget. With money that will probably only be available to this extent if a Brexit agreement is reached with the EU, he tried to satisfy the spending list of the Tory MPs, no doubt in order to increase the likelihood of such an agreement being reached. Even though he managed to prevent Brexit hardliners and the members of the Northern Irish DUP to use the budget as an opportunity to attack the Prime Minister Theresa May, Sterling was unable to benefit. The market is entirely certain that the British economy will only be able to benefit from the attested end of austerity announced yesterday if an orderly Brexit is achieved. An agreement does not seem to be any closer than two weeks ago at the EU summit. A solution on the Irish border is still not in sight so that there is still the threat of a no deal Brexit on 29thMarch 2019. And that is all that matters for Sterling at the moment.

OTC Outlook and Options Strategy:

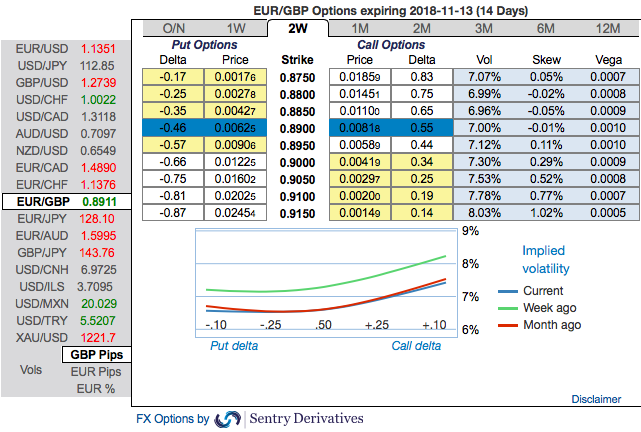

Please be noted that EURGBP implied volatilities of short-term tenors are shrinking away, while long-term tenors are rising. Positively skewed IVs of 2w have been well-balanced on either side, while the same has been indicating more bullish risks by bidding OTM call strikes.

Rising risk reversals of this pair are also signifying the same hedging sentiments (upside risks).

Hence, we devise diagonal credit call spread on hedging grounds that addresses both short-term downswings and long-term upside risks.

This option strategy to keep the potential bullish price risk caused out of fundamental events on check.

Keeping the both fundamental and OTC factors in mind, it is advisable to initiate long in 2M ATM 0.51 delta call, simultaneously, writing 2w (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the underlying spot FX price is anticipated to drop moderately in the near term and spikes up in the long-term.

The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 6 levels (which is neutral), while hourly GBP spot index was at -175 (bearish) while articulating (at 11:37 GMT). For more details on the index, please refer below weblink:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence