Although the Yen appears under pressure momentarily as BoJ caps nominal yields and risk sentiment holds up, but the move in relative real yields between Japan and the US represents a clear case for a weaker yen. The risk is for risk sentiment to change, thus the resilience of the risk mood bears watching because it is the key to the yen's continued weakness.

It has fallen by over 7% against the dollar since the election, more than any other Asian currency. A steady move higher in US yields is not expected to trigger a durable deterioration in risk sentiment for a while.

In addition, the BoJ’s strategy of capping nominal yields is paying dividends, as any pickup in domestic inflation expectations drives Japanese real yields down. The USDJPY, therefore, has scope to rally considerably further. We look for the USDJPY to reach 120 by September.

The dollar is unlikely to strengthen due to a flight-to-quality but would be boosted by higher US long yields being lifted by a sharp repricing of US inflation expectations.

Shorting the costly vols to trade a gradual move uncertainty is not going to lift volatility until the environment turns risk-off. So far, the Trump victory has not triggered such a shift. On top of that, the USDJPY uptrend is likely to slow down after the initial topside acceleration in autumn 2016.

As the suspicion, the Japanese central bank’s yield control transferred rates volatility towards FX volatility. But yen depreciation should now be more gradual. The recent fast upside lifted the 6m implied volatility to its highest level since 2014.

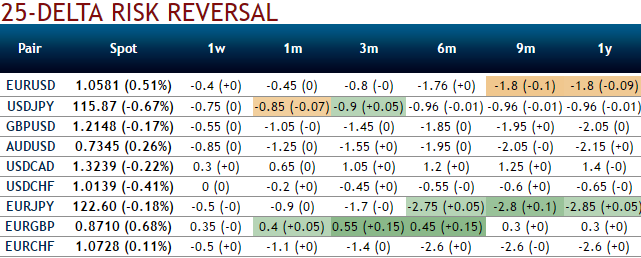

USDJPY 1m risk reversals and 2m IV skews are evidencing mounting hedging interests for downside risks (while articulating).

While the 2m realized volatility peaked at 18, it is already retracing much lower. With no risk-off shift in sight, and vega volatility still having to adjust to short-term dynamics, a short volatility structure makes sense.

Accordingly, a trade on “buy right-and-hold tight” logic is designed so as to match volatility regimes. It states the volatility but should suffer from initial negative convexity.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated