The key attention today will be on the Fed but if you look through the “What to watch today”, the answer is rate hike of 25 bps tonight is fine, but how much in 2018?

The Fed will almost certainly hike rates by 25bp tonight. In fact, the markets put almost a zero probability of no hike and a small outside chance that they could move by a full 50bp! Expectations are for a hawkish statement and an upward drift in the Fed members “dot plot” forecasts of future rate hikes, although views differ on how much. Currently, the median expectation of the Fed members is for three hikes next year. Expect a huge reaction if this shifts to four: the market has been moving steadily towards the Fed’s views on hikes but at this stage only prices two hikes in 2018.

While BoJ, on the other hand, is scheduled for next week for its monetary policy (on 21st Dec). As long as the Japanese rates market is dormant due to the BoJ commitment to monetary easing, the currency will likely stay driven by the dollar leg. But we think that won’t be the case forever: at some point, the yen leg will come out of hibernation.

We could foresee only a small chance of that commitment waning in 2018 because the inflation rate won’t get anywhere near 2%, but the net result is a huge skew in the range of outcomes for the USDJPY.

Buy USDJPY 1y put spread strikes 106/103, global knock-in 116 Indicative offer: 0.33% (vanilla: 0.75%, spot ref: 113.45)

A USDJPY 1y put spread strikes 106/103 would cost 0.75%, thus providing a maximum payoff of 3.9 times the premium. Setting a global KI at 116 more than halves the price to provide leverage reaching 8.8 at 103 in one year.

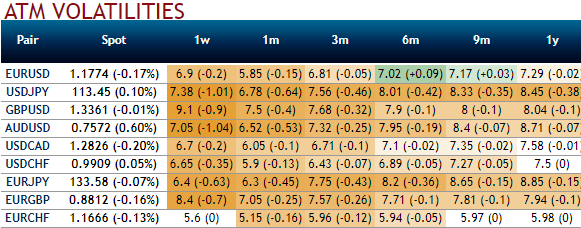

Selling USDJPY 1y skew: Please glance through the above nutshell showing depressed IVs across all tenors, in selling downside strikes, buying USDJPY puts is paying for the negative skew of low strikes. As we don’t foresee USDJPY crumpling below 100, needless to buy the total downside. Accordingly, we also finance our puts by selling the downside skew via put spreads.

In setting a topside knock-in, near-term, USDJPY should be initially mildly supported by mounting US yields. This suggests conditioning medium-term put spreads by a topside knock-in. Such a barrier will cheapen the vanilla trade, as the bearish skew discounts the market-implied probability of bullish moves.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 22 levels (which is neutral). While hourly JPY spot index was at shy above -73 (bearish) while articulating (at 07:20 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?