In just a week, markets went from doubting a March rate increase to viewing one as a sure bet. The central bank's top brass engineered the change by speaking in favor of a hike, culminating in Fed Chair Janet Yellen's endorsement on last Friday.

What changed to push central bank policy makers from the neutral stance that Fed-watchers saw in their January meeting minutes to the brink of a rate increase? Not much, if you're looking at U.S. data. The fact that nothing deteriorated was enough to clear the hurdle for a March rate move, especially because steady domestic data have come alongside a slowly-improving international outlook – a major shift from the situation at this time last year, when global risks helped to stay the Fed's hand.

The charts below illustrate the steady U.S. economy and sunnier international situation that have given policy makers the confidence to prime markets for a March 15 hike. As a result, you could see the reflections of underlying factors in OTC markets.

OTC Updates: Please be noted that the mounting hedging sentiments for all dollar crosses across different tenors, you can figure this out in nutshell showing risk reversals.

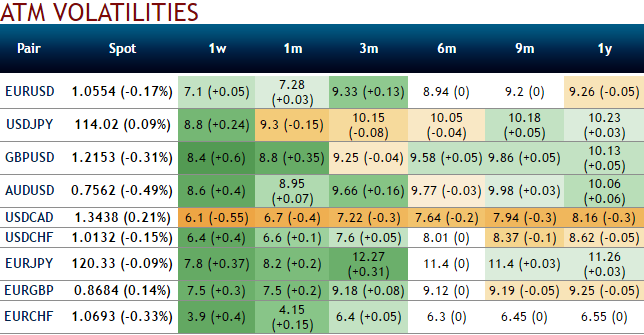

The implied volatility of ATM contracts of all dollar crosses are gaining traction across all tenors ahead of Fed monetary policies (see 1-3m tenors). This volatility observation is absolutely suitable for tenor selection in diagonal option spreads.

Rising negative flashes indicates active hedging sentiments for these downside risks and vice versa.

Acknowledge the gaining traction in the hedging sentiments of USD with higher negative risk reversals of dollar crosses versus euro, sterling, and Aussie dollar would imply dollar strength, while upside risks in dollar against Swiss franc, yen and Canadian dollar in long run is justifiable by positive flashes when you have to anticipate forwards rates and observe the spot curve of this pair (see IVs, RR nutshell, Sensitivities, and compare with spot prices).

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal