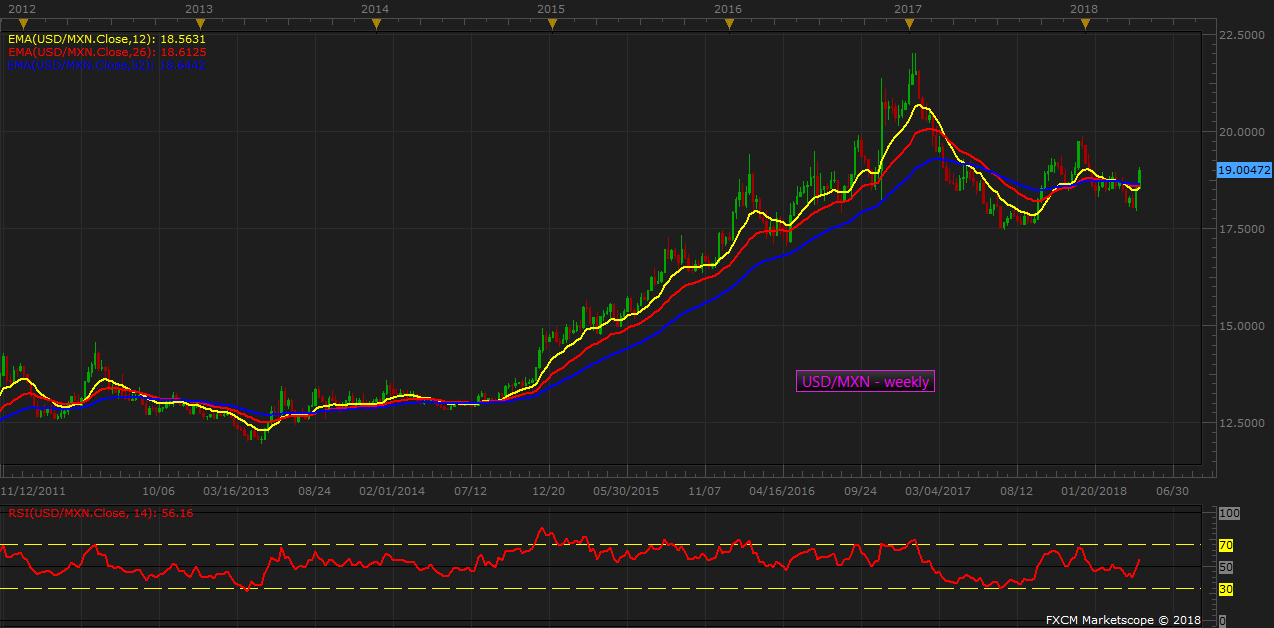

After steadily strengthening since January 2017 from 22 per dollar to as high as 17.45 per dollar, the Mexican peso has been signaling weakness in 2018. Bulls have been struggling to make further gain after topping in last July. Since then the Mexican peso has been trading in a range against the USD as interest rates in the United States continue to rise and as North American Free Trade Agreement (NAFTA) negotiations with the United States weigh.

In the past two weeks, Peso has weakened from as high as 17.93 per USD to 19 per USD as of today. Our calculations suggest that further weakness in the Peso is very much likely.

Trade idea:

Sell Mexican peso at the current rate of 19 per USD with a target of 22 per USD and the stop loss around 17.5 area.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022