Capitalize on minor upswings in short run for shorts side, keep longs for certain bearish trend to prevail in medium term:

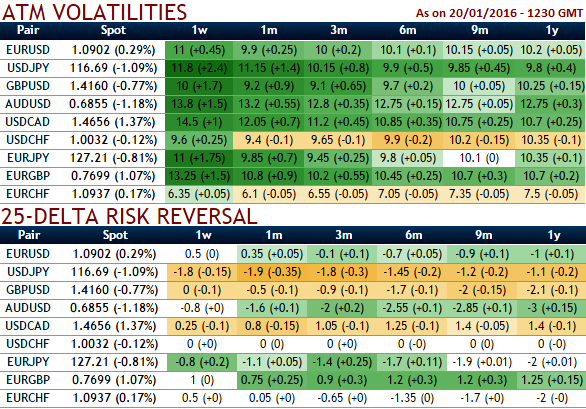

For us, it would be in narrow range of 125.856 - 115.750 but slightly bearish bias, the 25-delta risk reversals of USDJPY are at the highest negative figures among entire G20 currency space for next 1w-1m or so, but it is reckoned that any abrupt upswings in short run could be exploited for shorts.

This would mean that market sentiments for this pair have been bearish in medium term despite eyeing on any abrupt upswings for shorting opportunities and the market sentiments in medium run for dollar have been weaker against this pair. As a result, we reckon that for next month Yen may pretty much gain.

It is also observed that ATM contacts of USDJPY have gradually increased implied volatilities after the much awaited fed's meet has delivered that was in line with markets expectation, we did not see much of rate policy impact that could have propped up dollar's strength. We believe it was already priced in even before this event.

The delta risk reversal for the pair is still on higher negative values among entire G7 currency space for next 1w-1m expiries, but we believe some short upswings may be utilized for shorts.

The pair favours Yen's writers as the ATM IVs likely to perceive higher implied volatility at almost around 12% of 1wexpiries and 11.2% for 1m expiries that has increased from last week's 8.75%.

Thus , based on OTC hedging sentiments, we recommend holding longs on put ladder spreads that contained proportionately less number of shorts and more longs which would take care of potential slumps on this pair in long run and significantly higher volatility times.

So, shorting ITM put with shorter expiry (lets 1w contracts) would fetch certain yields as a receipt of initial premiums and hold 2 lots of 1M ATM and OTM put (preferably with longer expiry) since implied volatility is inching lower which is good for option holders.

FxWirePro: Risk reversal indicates Yen’s strength – capitalize on rallies for put writings in put ladder spreads

Thursday, January 21, 2016 10:30 AM UTC

Editor's Picks

- Market Data

Most Popular