Spotlight on Technical and Candlestick Pattern and Indications:

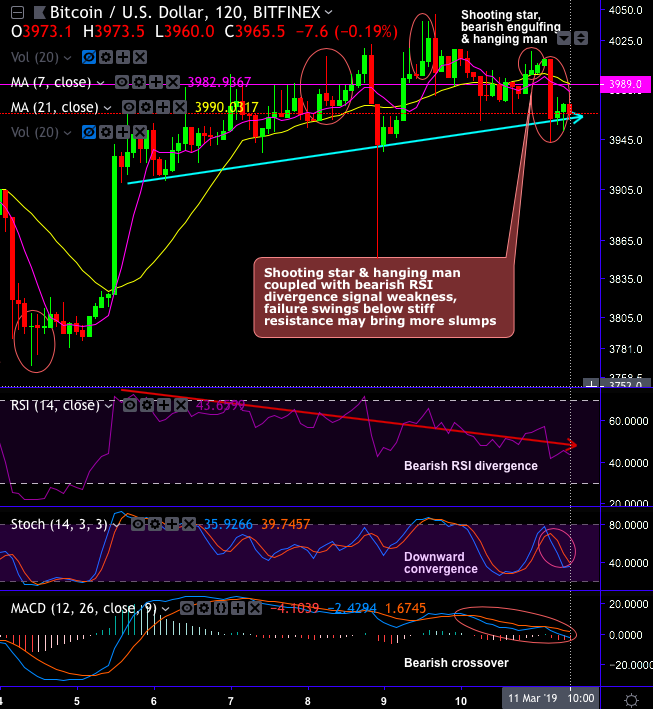

- Please be noted that we have traced out RSI bearish divergence on BTCUSD, ever since then the last month’s rallies seem to have been exhausted and bears resume of late.

- In addition to that, the pair also forms shooting star, bearish engulfing and the hanging man at peaks of rallies (refer circular areas on 2H charts).

- The minor resistance levels are observed at near $3,989 - $4,100 and the major resistance near $4,620 (i.e. 7-EMA levels).

- The minor support areas are observed near $3,934 and $ 3,909 levels.

- Please be noted that the weakness, for now, is intensified upon bearish stochastic crossover, and RSI divergence in the medium and short-term trend. While the trend indicators (DMA & MACD) also show bearish crossovers that indicate downswings to prolong further.

- Intermediate trend breaches below range & retraces more than 78.6% Fibos with bearish EMA & MACD crossovers, bearish pressures imminent as a current price well below EMAs.

- Overall, we could foresee the minor hiccups in the bitcoin price trend, but the major trend has been attempting to consolidate. On hedging grounds, it is wise to stay long hedge in CME BTC futures of mid-month tenors rather than holding underlying bitcoins.

- This Wednesday the latest round of CBOE XBT (XBTH19) futures expires. These futures contracts need to be settled on a predefined date, based on contractual terms. All CBOE contracts will have to be traded, or settled, before this date. There is generally a dip in the trading volume of futures around expiration dates, that coincides with a rise in volatility and potential short/long squeezing.

- XBT futures are cash-settled contracts based on the Gemini's auction price for bitcoin, denominated in U.S. dollars. Gemini Trust Company, LLC (Gemini) is a digital asset exchange and custodian founded in 2014 that allows customers to buy, sell, and store digital assets such as bitcoin, and is subject to fiduciary obligations, capital reserve requirements, and banking compliance standards of the New York State Department of Financial Services.

Currency Strength Index: FxWirePro's hourly BTC spot index is flashing -173 (which is highly bearish), while the hourly USD spot index was at 54 levels (bullish) at 11:09 GMT. Courtesy: Tradingview.com, CME

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields