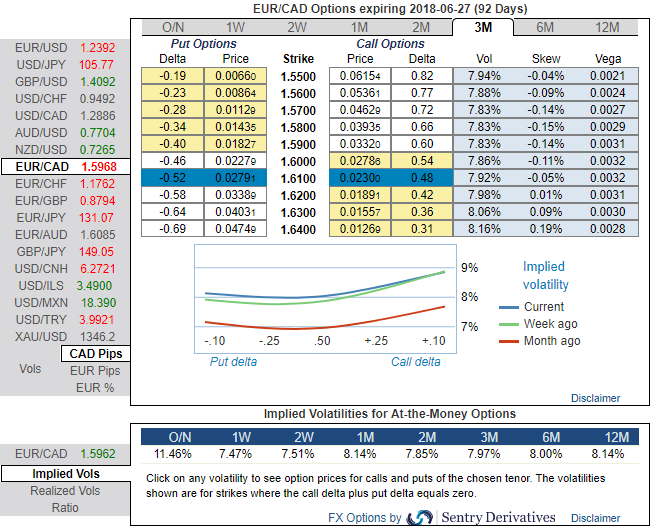

We wrote in our recently posted article on EURCAD hedging perspectives that run you through the straddle strategy whose implied volatility was considered to be very low, and therefore the tendency is likely to rise.

EURCAD ATM IVs of this pair is just shy above 8.1% for 1m tenors (refer above nutshell). As a result, straddles seemed suitable.

Otherwise, if you reckon that this doesn't suffice for long options, then go ahead long hedging via delta calls without giving in any second thought but on pure hedging grounds.

Alternatively, one can also configure a position with unlimited reward to mirror the long straddle, so you'll have to be net long option positions. Substitute choice seems to be a backspread that will also render cost-effective hedging vehicle as the underlying spot FX this pair has been spiking higher from last 2-3 months to resume bullish major trend.

Another would be a long option with additional short verticals further OTM. In both of these examples, you can arrange the legs such that theta and vega match your needs/expectations. And remember that you don't have to keep the legs in the same expiration series.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown 74 (which is bullish), while hourly CAD spot index was at -24 (mildly bearish) while articulating at 12:27 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025