Doji pattern candle is occurred on daily charts at 0.7294 levels and the trend on this chart has still been fragile as the RSI (14) is converging downwards with massive price dips. While %D line crossover is still on even after reaching oversold territory on slow stochastic. Overall, the major trend has been downtrend dominated by the bears with clear volume confirmation.

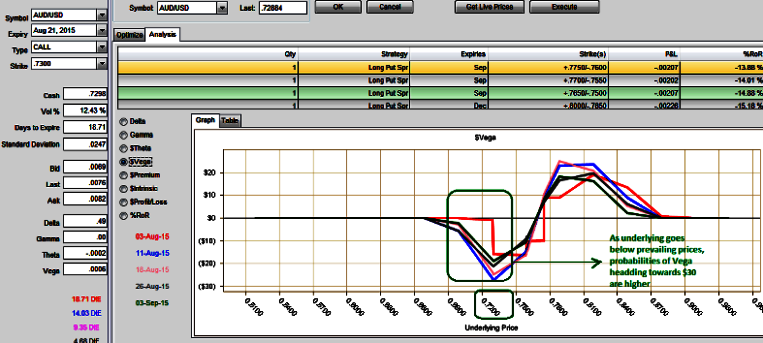

As you can make out from the diagram the implied volatility for near month at the money contracts of AUDUSD pair has been highest in the currency segment and is seen at 12.43%. Considering all these aspects we recommend deploying one touch binary puts in our strategy in order to extract leverage on extended profitability. By employing At-The-Money binary vega puts one can multiply returns by twice, thrice or even pour returns exponentially. But do remember these are exclusively for speculative basis.

The prime merits of such one touch option are high yields during high volatility plays. Wider spreads indicates lack of liquidity. The spreads for one touch AUD/USD options are constant time and barrier levels. Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times. You can see that in charts how every dips would propel Vega effects.

FxWirePro: Relentless AUD/USD downswings, higher IV exert pull on one touch vega spreads to speculate HY vols

Monday, August 3, 2015 7:33 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary