Following the end of the rate hike cycle in Mexico, the markets are now speculating when the first rate cut may follow. Against this background, today’s publication of the inflation report, as well as a speech by central bank governor Augustin Carstens, are of interest. In view of the still high inflation rate of 6.4% speculation of this nature seems premature to us though.

We believe that the central bank will no doubt want to be sure that inflation is moving towards the inflation target of 3% in a sustainable manner before taking a first rate step, and as a result we expect a lengthy rate pause. That means there is unlikely to be any momentum for the peso on this front. Instead, the NAFTA renegotiations might stir things up a little bit for the currency.

The second round of negotiations is scheduled at the end of this week. However, (negative) effects on the peso are likely to be limited. Recent comments on the part of US President Donald Trump, which once again suggested that the agreement might come to an end, only put short term pressure on the peso. The general point of view that the agreement is likely to remain in place in the future was not affected by this sabre rattling.

But investors may become a little more nervous and take a cautious approach towards MXN engagements. USDMXN is likely to trend sideways again in the near future.

The peso has come a long way from its Trump lows and screens overbought and overvalued at current levels, leading our LatAm team to turn underweight recently.

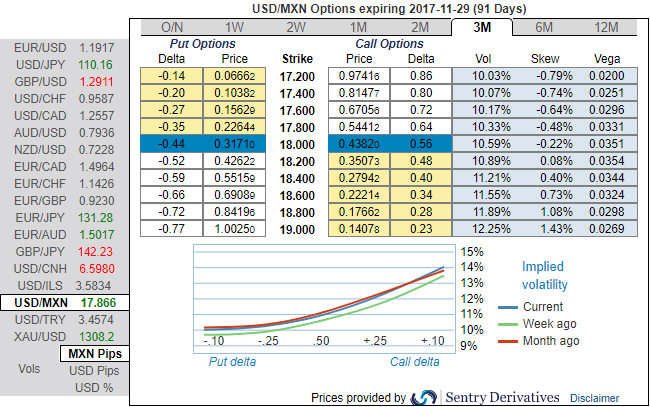

The standout feature of the USDMXN vol surface to us is the cheapness of risk-reversals, both vis-à-vis ATM vols and particularly relative to the amount of carry in forwards that allows for carry efficient expressions of bearish directional views or tail risk hedges.

Please be noted that the 3m IVs of USDMXN are indicated bullish risks, the telling statistic from the graphic is that that the static carry of delta hedged vega-neutral 3M skews is a very substantial 2.5 vol pt., near the upper-end of its 2-yr range.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics