We reckon the monetary policy divergence should be the major factor in the H2 of the year for a lower AUDUSD in the long run and interim upswings in a short run as the today’s RBA cash rates likely to remain unchanged, whereas the Fed prepares to stiffen again.

As a result, the pair gaining more traction for upside targets up to 0.7651 levels in near terms. The bullish moment seems healthy so far but this shouldn’t be deemed as an investment opportunity.

Elsewhere, please be mindful of OTC order flow analysis:

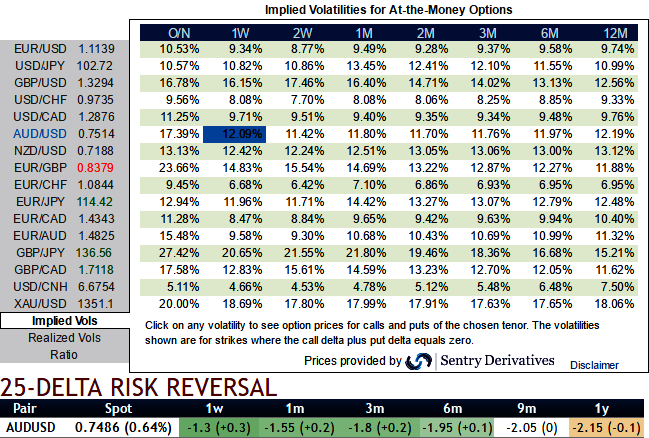

The implied volatility of ATM contracts for near month expiries of this the pair is spiking higher at around 12%.

While delta risk reversals flashing up progressively with positive numbers that signify hedging arrangements for upside risks in a short term.

While current IVs of ATM contracts are at the 3rd highest levels but likely to perceive around at an average 12% in long run that would divulge pair’s gain contemplating risk reversal arrangements.

Hence, considering OTC market reasoning, to match up with upside risks in a short run and robust long-term bear trend, we reckon deploying credit combinations comprised of ATM instruments both on hedging as well as speculative grounds are advisable.

The spot FX of AUDUSD is trading at 0.7514, and is anticipated to spike up moderately in the next few trading sessions to come.

1W ATM calls are trading 25% more than NPV, while IVs are at 12 so we think it is unjustifiable%.

Therefore, we decide to initiate bull option combinations at net credits capitalizing on IVs, RR and writing overpriced options.

So, write mid-month (2.5%) out of the money calls and near month out of the money put, simultaneously, go long in 1m (-1%) in the money put with 65% delta.

Please be noted that in this instance, the put we short is out of the money with an anticipation of AUDUSD’s rise and along with OTM calls shorts that are likely to be far out of the money as the underlying spot has restrained upside potential up to 0.7651 levels.

And to hedge long term bearish risks we’ve chosen 2m ITM longs in puts that would save your spot FX payable exposure if any would be protected on account of potential dips in this pair. The initial credit received for this trade would reduce the cost of hedging.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise