Technical glance:

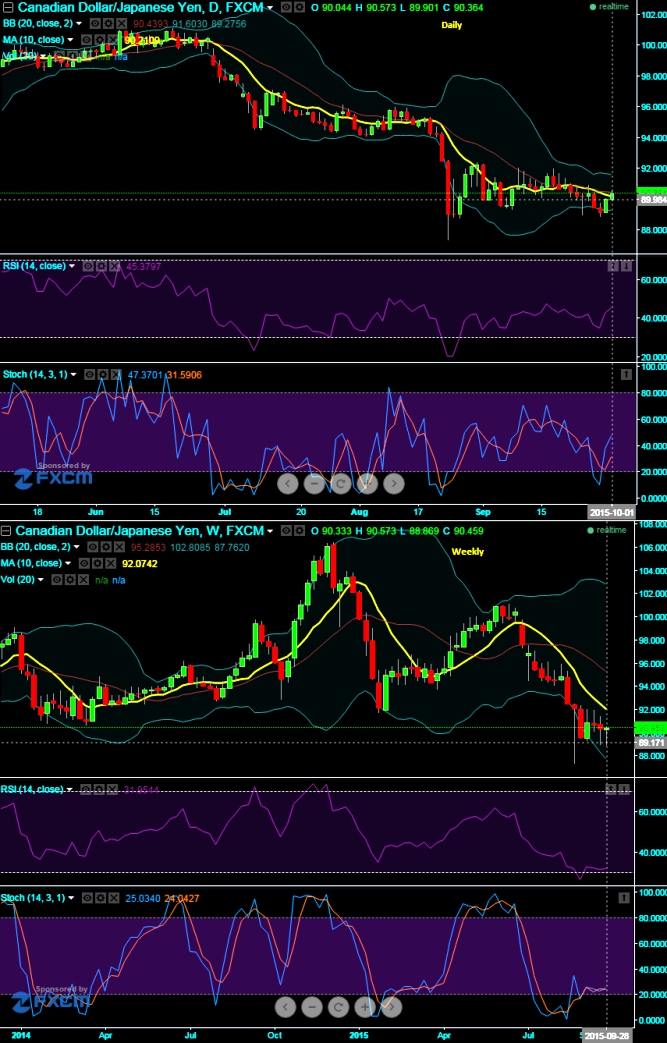

Lot of puzzling has been happening in CADJPY when we consider the intermediate trend of this pair, bullish candles such as dragonfly doji and at 90.217 on daily and likely dragonfly doji again for this week with one day to spare, on the contrary leading indicators on the weekly charts are still converging downwards that would still suggest the previous downtrend trend to prevail.

Weekly RSI has still been converging with price slumps near oversold territories (Currently, RSI at 31.4185), while slow stochastic is also reaching oversold zone but not trace of %K line crossover for price recoveries. The current prices on moving average remained well below moving average curve which signals long term bearish sentiments.

Currency Hedging Framework: (CAD/JPY)

Price recoveries on this pair is on the cards and it is sensed that all chances of Yen may also still look superior over Canadian dollar in long term future but no dramatic differences in prices on either direction, we advise to hedge this pair with below recommendations.

Currently the pair is trading at 90.390 with volatility of ATM contracts marginally inching higher (at 12.5%). We recommend buying OTM -0.49 delta put while simultaneously shorting ATM put with similar expiries and buy OTM 0.5 delta call while simultaneously shorting an ATM call with similar expiries. This strategy is structured for a larger probability of earning a smaller but certain profit as CADJPY is perceived to have a low volatility.

The highest return for this strategy is achievable when the pair at expiration is equal to the strike price at which the call and put options are sold. At this price, all the options expire worthless and the options trader gets to keep the entire net credit received when entering the trade as profit.

FxWirePro: Prefer CAD/JPY butterfly spreads as downtrend to halt but certainly not an uptrend

Thursday, October 1, 2015 11:14 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary