Brexit likely to ruin GBP prospects which is a big tail risk, even if it won't be a factor until the date of the referendum is known. We estimate the risk of Brexit at 45% and the accumulated negative shock to the economy at 4-8% over five years.

This will also likely to have an adverse impact on Eurozone growth to take down 1-2% over the same period, but that still implies UK real GDP growth averaging around 1% per annum for the five years after the decision to leave the EU.

UK GDP is not actually the issue - we expect 2% real GDP growth in 2016, which is way beyond the Eurozone's 1.6%, even if it is below the 2.8% we forecast for the US.

And the current account deficit looks to have peaked, or at least to have been revised down by the ONS as it recalculates the investment balance. But growth does not prevent MPC/Fed divergence, and a 3% GDP current account deficit would still be excessive in the event of Brexit.

By end-2016, we suppose policy rates to be 1 pp higher than they are today in the US, but only 25bp higher in the UK.

With GBP/USD tracking short-term (2Y) rate differentials, we foresee no backing for the pound against the dollar unless the US Fed is more dovish than markets expect, or the chances of an MPC hike increase dramatically.

The close encounter is on the cards in 2016 for EUR/GBP as the pair is more one of valuation, which is tricky to judge, though most estimates of PPP suggest significant sterling overvaluation, while the UK's real effective exchange rate has risen by more than a third since end-2008, to its highest level since 2003 (though FEER estimates are higher, at 0.74).

We remain bears of GBP/USD, as the MPC is deferring, the 'Sword of Brexit' is hanging over confidence, and EUR/GBP valuations go hard-pressed. We look ahead to see cable to drop below 1.40 by Q3 2016 and we see EUR/GBP struggling to break below 0.70, even as EUR/USD falls.

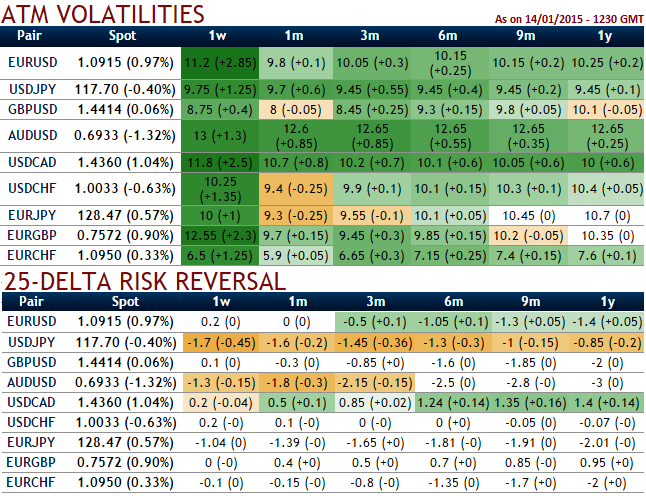

Stay short in GBP/USD through diagonal put spread, hold 2m GBP/USD (+1% ITM strikes & -1.5% OTM strikes with shorter expiry) debit put spread.

Stay hedged in EUR/GBP upside risks via straps with cautiously balanced weights, with risk reversal being neutral in short run (at zero) dipping IVs forecasted, go long on 1M at the money 0.52 delta call, 2M out of the money (2% strike i.e. our below cap) 0.35 delta calls and simultaneously go long on 1M at the money -0.48 delta put with net debit.

FxWirePro: Potential risks revolving GBP over Brexit crisis in 2016 and hedging arrangements

Friday, January 15, 2016 1:03 PM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary