Before we proceed further into strategies, let’s just glance at what’s going on in the bullion market space and OTC hedging outlook.

Gold price has constantly been dipping from the highs of $1,365.16 to the current $1,211.65 levels within a span of 4-6 months.

Furthermore, there have been the cyphers for prolonged weakness in the precious metal space. Safe haven demand has not flowed into Gold and its precious metal cousins; market-watchers seem to prefer the greenback and US assets instead, with the DXY rising beyond its 95.0 handle of late. Physical and paper gold demand remained weak, while higher US interest rates into 2018 could cap gold’s rally.

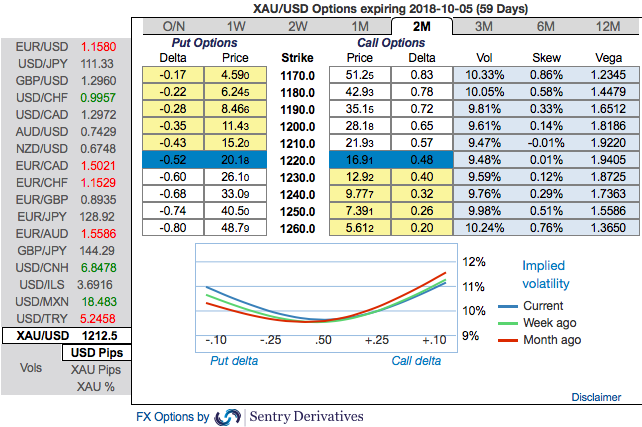

OTC updates: 2m IV skews have been well balanced on either side and signify the hedgers’ interests on both OTM call and put strikes. Whereas the risk reversal numbers are indicating bullish price risks.

It is reckoned that as per the OTC indications as shown above and the prevailing trend in bullion markets seem to be reasonably addressed by hedging participants, thus, we advocate below option strategy to keep uncertainty in spot gold prices on the check.

The combination of 1m bullish neutral risks reversals and shrinking IVs are conducive for writing overpriced OTM calls. Amid this perplexity in hedging sentiments, the risk-averse traders who are dubious about upside move, using three-leg strategy would be a smart move to reduce hedging cost.

Initiate longs in XAUUSD 2M at the money -0.49 delta put, and go long 2M at the money +0.51 delta call and simultaneously, Short 2w (1%) out of the money calls. Thereby, we favor bulls as we foresee more upside risks by keeping longer tenors on call leg.

On trading perspective also, the strategy likely to fetch positive cashflows regardless of underlying price swings with more potential on downside and with cost effectiveness.

One interesting defensive RV set-up is long Gold/AUD ATM vs. short AUDUSD puts (both legs delta-hedged).

At multi-year lows, an artifact of uber-depressed Gold vols, the XAUAUD - AUDUSD vol spread can be considered to be an RV-friendly expression of outright XAUUSD vol, which by all accounts is quite cheap in its own right.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -22 levels (which is mildly bearish), while articulating at (14:02 GMT). For more details on the index, please refer below weblink:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One