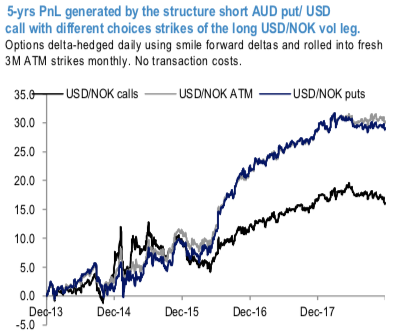

The flash crash the FX market experienced recently was different to similar episodes of this nature in the past and in some way more intense. From the above diagram, it is observed that the choices of USD put /NOK calls and ATM are associated with the most luring profit profiles, although one could argue that the long USD call / NOK put position (more expensive premium-wise due to the skew) could offer a better protection for offsetting the short-vol leg were risk-off to resume.

Dual digitals can offer an alternative, directional implementation of the same trading theme, by further allowing for a correlation-induced discount if choosing the strikes appropriately. A scatter plot of vol (x-axis) and spot (y-axis) 3M historical returns for AUDUSD displays that, on average, thanks to the skew, declining volatility supports an appreciation of the currency in the spot market.

Therefore, one can consider a strike in the AUDUSD leg to be above the spot value. A similar reasoning could allow considering a strike above spot for USDNOK, where we find potential for the vol to rise modestly. This scenario, which would possibly play out in case of a range-trading market for the US dollar, would allow a significant correlation discount, given that AUDUSD and USDNOK would move in the same direction and the market prices a negative implied correlation on the pair. However, in the trade below, we consider a slightly more conservative choice for the strike of the long USDNOK vol position (1% ITMS).

Trade tips:

A 3M at-expiry dual digital structure (AUDUSD > 2% OTMS, USDNOK > 1% ITMS) costs 12.8% USD (10.3% mid), allows a 7.8X max leverage and offers 60% discount against the cheapest of the two dual digitals (mid vs mid).

We advocared buying a 3M ATM USDNOK straddle @8.5/8.75 vol indic vs. selling a 3M 25delta AUD put / USD call @8.5/8.7 vol indic, the trade was initiated when AUD was trading at 0.7227 level in vega neutral notional, spot ref USDNOK 8.7502, AUDUSD 0.6956. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly BTC spot index is inching towards 128 levels (which is bullish), while hourly USD spot index was at 37 (mildly bullish) while articulating (at 11:25 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential