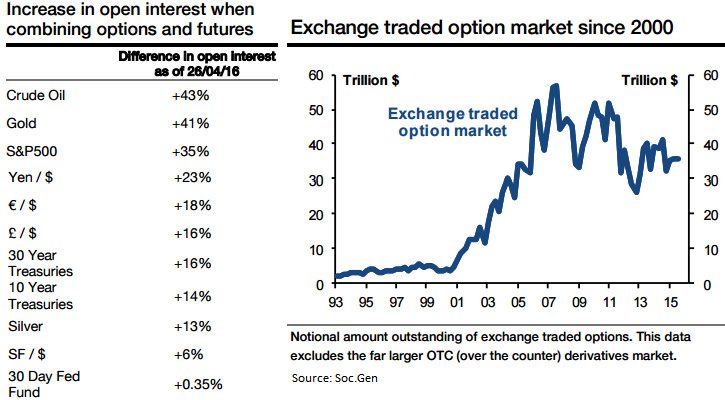

Option markets crucial in the analysis of market positioning, in 2007, the notional amount outstanding of exchange traded options reached a peak of 60 trillion US dollars.

Since then, volumes have stabilised but the importance of the options for the analysis of market positioning is undeniable.

The table on the left shows the impact of adding options to the analysis based on options & futures, measured by the increase in open interest.

The above table indicates the most impacted assets in decreasing order considering open interest data:

Open interest on Gold (+41%) and Crude Oil (+43%) show that these are commodities that are the most impacted by this change in methodology.

Open interest on equities (+35% for the S&P 500) and bonds (+14% for 10-Year Treasuries) also strongly increases.

Exchange traded options and futures are actually a small part of the whole derivate market that includes OTC (over the counter) transactions as well.

FX still indicating some fears

With the Fed increasingly behind the curve, long dollar positions have diminished significantly against most currencies, but not against the UK pound (right-hand chart below).

In view of the 23 June Brexit referendum, funds have found safer alternatives by increasing their net long positions on the Swiss franc and the Japanese Yen.

The results in odd combinations, such as in Japan with negative interest rates but net long positions on both the yen and the Nikkei.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022