We could still foresee the AUD biased lower over the next 3-6 months on the back of modest near term softness in commodity prices and Fed tightening (Q1 in 16 target towards 0.67), before finding some support later in the year (Q4 in 16 target at 0.71) as the terms of trade trough and the domestic economy continues to rotate away from mining-related activity.

For AUD, rate solidity remains a bearish force for the currency, but in 2016 it will be driven by Fed hikes rather than RBA easing (we think the RBA is done).

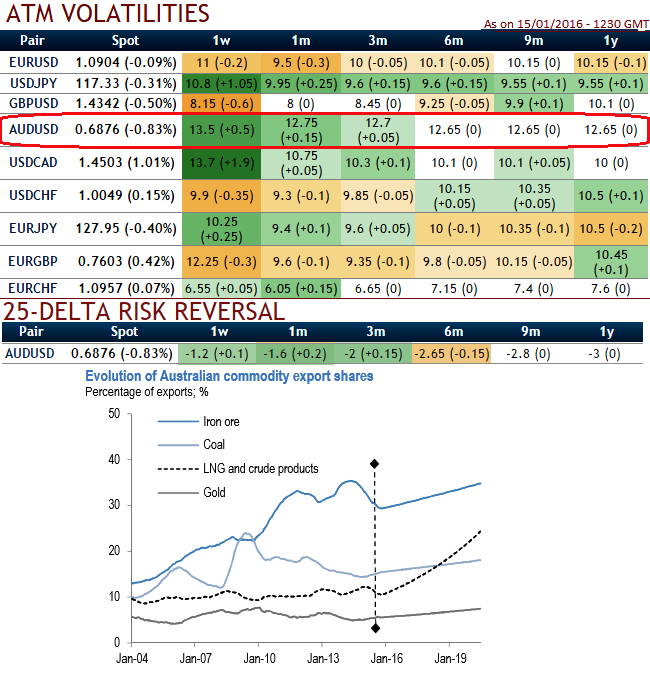

The greatest difference, however, is the terms of trade, which we think is bottoming as iron ore prices move within a range and LNG exports rise, thus insulating the trade balance from higher oil prices next year. AUD/USD is forecasted 0.68 in Q2, 0.72 in Q4.

Offsetting AUD/USD long term risks via long AUD/USD 3M ATM straddles financed with AUD/JPY 1Y 25D puts (delta-hedged):

AUD/USD is presently the highest realizing dollar vol among G10 currency space or any EM basket and same is the case with IVs (see IV & risk reversal nutshell), proven one of the improved gamma buys of 2015 also, thanks to an outsized 12% decline in the currency.

If our anticipation goes right in next year's spot trough 6% below current market, Aussie dollar should once again evidence its grit as a solid vols hold due to its exclusive prominence as a high-beta currency that parks in the sense of Fed monetary cycle and twisters of EM/China crisis.

In line with our preference to sell rich yen skews, we advocate financing AUD/USD 3M straddles by selling 1Y 25D AUD puts /JPY calls in vega-neutral amounts.

The technical set-up of the RV is appealing in terms of entry levels, and realized vol spreads look asymmetrically biased in the direction of AUD/USD outperformance.

Selling cross-vol/buying USD-correlation also fits with a market environment that is likely to be dollar-centric in the early stages of the Fed cycle.

FxWirePro: Offset AUD/USD turbulence with AUD/JPY - Own USD gamma and correlation

Monday, January 18, 2016 1:01 PM UTC

Editor's Picks

- Market Data

Most Popular