The rules of the game for OPEC producers would clearly skew incentives to maximize output in the short term. Any subsequent negotiations would likely be based on prevailing output levels, hence the higher the better. Similarly, we would expect a rapid return to service of the 350 -400 kbd of non-OPEC output that is currently constrained. Consequently, oil markets would struggle to clear. Furthermore, US E&P companies have used the recent recovery in prices to hedge 2017 output at around $55/bbl, thus any response from US shale oil may be more muted than headline prices would seemingly dictate.

We note that aggregate hedge ratios for 2018 appear low, relative to historical norms and 2017 levels. Hence a more vigorous response in supply would likely develop in 2018, but that would be too late to save prices from considerable pressure in the medium term.

Conversely, if OPEC is able to not only extend the current agreement but hold its nerve and maintain discipline through until the end of the year, the 2017 market balance appears very supportive of prices above $60/bbl.

Revised balances this month point to a quicker pace of tightening in oil markets than previously envisioned. This does, however, jar somewhat with the bottom-up data that still provides limited evidence of a sustained tightening. With the expectation that markets are set to tighten in coming months we re-initiate long positions in Brent outright, and in the WTI curve. If OPEC fails to agree to extend its production cuts these trades will suffer.

However, given the level of our conviction on the likelihood of a deal, we believe now is an opportune time to re-enter a long exposure to oil.

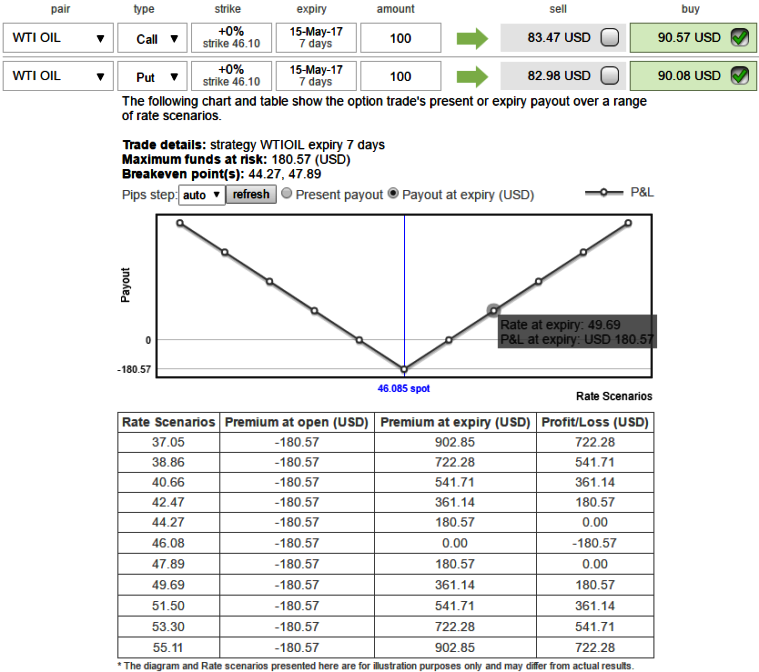

Go long the August 2017 WTI crude ATM Straddle against short July 2017 WTI crude ATM Straddle

We expect most of the event risk in 2q’17 will revolve around the OPEC meeting.

We, therefore, sell a July ATM WTI crude straddle and buy the August ATM straddle. While the expiry of the July contract coincides with the OPEC meeting isn’t ideal we think the majority of the price movement will occur after this date.

Go long the August 2017 WTI crude ATM Straddle against a Short July 2017 WTI crude ATM Straddle at $1.80/bbl. Please be noted that the above diagram shows that the payoff structure of 1w straddles of WTI crude regardless of swings.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?