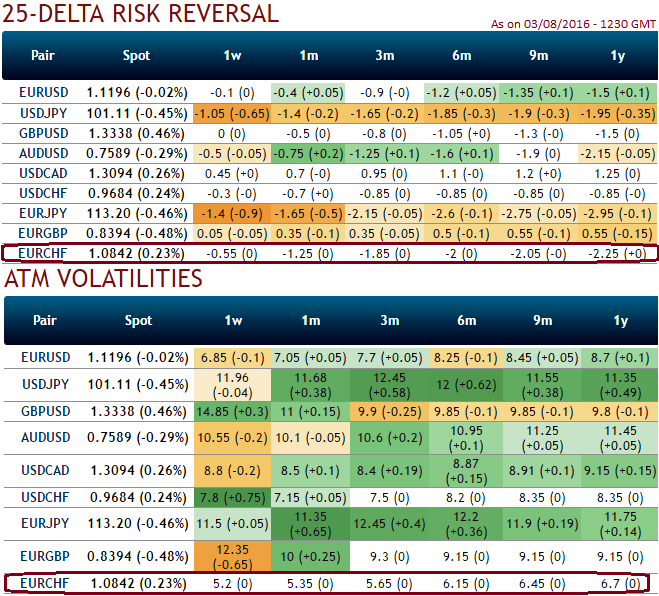

Please be informed that the implied volatilities of EURCHF ATM contracts of all expiries have been the least among G10 currency segment.

While, the 25-delta risk of reversal of EURCHF has also not been indicating any dramatic shoot up nor any slumps, but seems to be one of the pairs to be hedged for downside risks as it indicates puts have been relatively costlier.

Option-trade recommendations:

EURCHF’s range bound pattern is still persisting but some bearish candles are indicating slight weakness on both weekly and monthly charts, (Ranging between upper strikes 1.1110 and lower strikes at around 1.0725 levels.

We could still foresee range bounded trend to persist in near future but little weakness on weekly charts is puzzling this pair to drag southward targets but very much within above stated range.

As a result, we recommend below option strategies using right options, thereby, one can benefit from certain returns.

Naked Strangle Shorting:

Short 1W OTM put (1.5% strike difference referring lower cap)and short OTM call simultaneously of the same expiry (1% strike referring upper cap) (we reiterate, preferably short term for maturity is desired).

Alternatively, one can also prefer iron condor on the same lower IV circumstances. To execute the strategy, the options trader buys a lower strike OTM put, sells a middle strike ATM put, sells a middle strike at-the-money call and buys another higher strike OTM call. This results in a net credit to put on the trade.

Overview: Slightly bearish in a short term but sideways in the medium term.

Time frame: 7 to 10 days

At current spot at 1.0840 with range bounded trend keeping in consideration, we would like to remain in a safe zone by achieving certain returns though shorting a strangle.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?