The RBA board convene tomorrow for monetary policy review. The expectation on the cash rate to remain unchanged, however, would be looking for any change to the Bank’s AUD commentary.

There would be interest in the statement language, especially on the currency, with AUD/USD up 7% since the Mar meeting, the strongest in the G10.

Datawise, on Mon we see Feb retail sales and building approvals, and then on Tue the Feb trade balance.

Retail sales in Australia remained unchanged from a month earlier in February of 2016, following a 0.3% rise in January and below market expectations of a 0.4% increase.

We changed our cash rate profile before Easter. The projections are that the RBA to stand pat at 2% out to end-2017 at least. However, the balance of risks remains tilted to the downside.

Over the longer-term, we expect AU growth to remain subpar and AUD to drift lower. There are a few key things to watch in 2016. Governor Stevens retires in Sept 2016 while a federal election must be held by Jan 2017. AU’s current account deficit is also worth tracking.

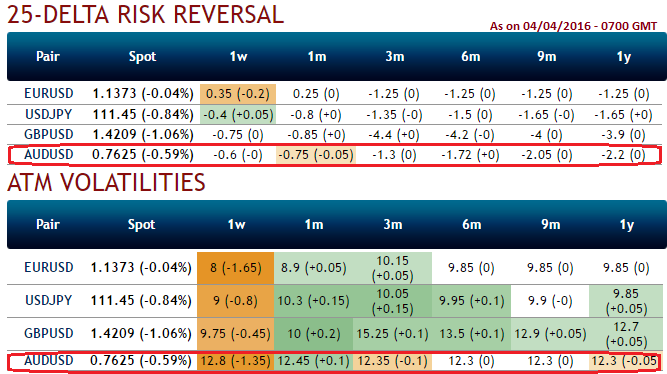

With above fundamental drivers of monetary policy, we expect no dramatic change in underlying FX impact, which in turn, we see bearish neutral hedging arrangements for next 1 week's expiries,

Reduced IVs are interpreted as OTC market is well balanced for long term hedging and bearish neutral risk reversals are popping up because even speculators in FX options markets might've gambled that central bank's move tomorrow would not bring in much of the implied volatilties.

If you're willing to assume some risk in return for the chance to exchange currency upon maturity at a better rate than the current FX forward rate then the risk reversals are recommended.

Because, FX option transactions are entered into as a hedge against an adverse probable future occurrence. Forex options are contracts where the buyer has the right, but not the obligation, so in AUDUSD case participants might have thought that there wouldn't be potential risk from central bank's outcome tomorrow.

We wouldn't be surprised even if the AUD continues to march higher as the global data pulse shows improvement and as global central banks remain dovish.

The recent strength has been more about USD weakness and a dovish Fed, and has manifested despite a stalling in commodity price strength.

Tomorrow's, the RBA’s latent reactions to this recent strength will be the centre of attention.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX