We have SNB scheduled to announce monetary policy assessment this week and Libor rate that measures London interest rate for 3-month Swiss franc deposits. The Swiss National Bank is also expected to sit on its hands this week. In fact, the SNB needs to continue lagging the ECB in policy normalization in order to nudge EURCHF gradually higher. Though we still see EURCHF higher in time, the exuberant phase of franc depreciation is behind us.

The bullish Swiss franc could only be foreseen given:

1) The SNB desists from intervention over a multi-month period.

2) The ECB backpedals on tapering QE.

3) Concerns around Italian elections mount in 4Q’17/1Q’18.

4) The SNB starts to shrink its balance sheet.

It’s probably fair to say that the conventional wisdom regards the franc as being little more than an anti-euro and that an extended recovery in the single currency is apt to sink the franc because it has the potential to unleash substantial pent-up capital outflows from CHF. While there is clearly some merit in these arguments, we do not believe that the franc can be satisfactorily understood through a simple, single-factor framework such as this.

In our view, rather, the franc continues to enjoy a substantial balance of payments supports through Switzerland’s enduring current account surplus. And while the removal of existential euro risk may well be a necessary condition for a sustained increase in unhedged capital outflows from private investors as opposed to the SNB, it is unlikely to be sufficient.

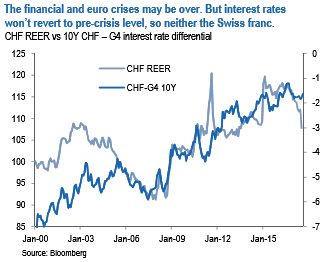

In our view, interest rate differentials will be a more significant driver of capital outflows than the broad euro trend and we remain skeptical that the franc has embarked on a steep depreciation trend as there is no suggestion that rate spreads can revert to anywhere near their pre-crisis levels. The forecasts are thus unchanged this month and show EURCHF only very slightly above spot at 1.15. That having being said, we do acknowledge that the risk bias around this conservative forecast is for a weaker franc, potentially up to 1.20 on EURCHF, in the event of an accelerated or a more aggressive tightening in ECB policy rates.

There simply is no wall of safe-haven money that should flood out of CHF, irrespective of how bright the euro’s prospects. We believe this is a key distinction between our conservative outlook for CHF and the market’s rather more bearish prognosis.

This neatly brings us on to the central issue of interest rate differentials. It was the post-GFC collapse in global rate spreads which ultimately triggered the multi-year uptrend in CHF, as Swiss investors were no longer incentivized to take FX risk or recycle the current account surplus (this is why the SNB has needed to single-handedly recycle the surplus through massive and sustained FX intervention). Thus, it would be downgraded CHF forecast when there is evidence of rate differentials shifting against CHF; for now, long-term rate spreads remain quite supportive for CHF (refer above chart). Courtesy: JP Morgan

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal