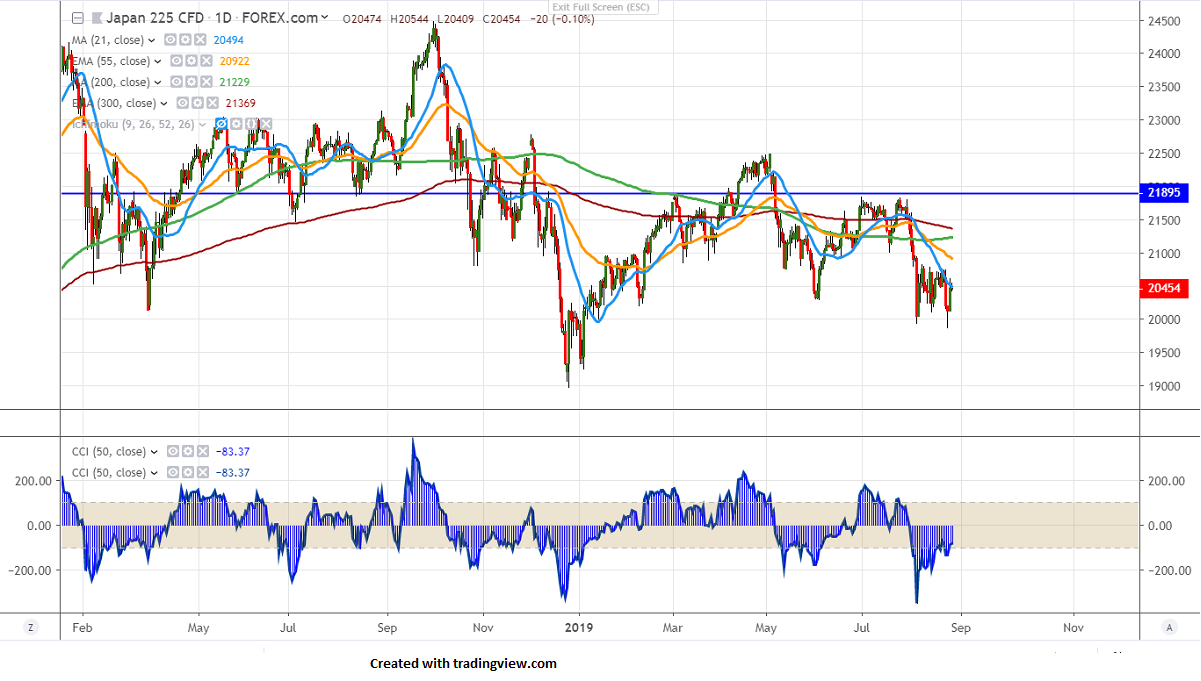

Major resistance- 20800

Major support - 19900

Nikkei has regained sharply following the footsteps of global peers on slight easing of US-China trade tension. The US 10 year bond yield has recovered more than 10 bps after hitting 3 year low. And spread between US 10-year and 2-year still inverted. The index hits high of 20619 and is currently trading around 20454.

US Market- The Wall Street has closed higher with Dow Jones and S&P500 25898 (1.05% higher) and 2878 (1.10% higher).

Japanese Yen- USDJPY has lost nearly 70 pips after showing a 200 pips recovery. Any break above 106.70 confirms minor trend reversal.

Shanghai composite- Shanghai has jumped more than 2.5% on slight easing of the trade war. It is currently trading around 2900. Any close above 2911 confirms minor bullishness and a jump till 2960/3000 is possible.

Technically Nikkei facing near term resistance around 20800 and any minor jump can be seen only if it closes above this level. Any close above targets 21220/21500.

On the flip side, near term support is around 19900 and any violation below this level will take the index till 19600/19200. The minor support is around 20400/20100.

It is good to sell on rallies around 20525-550 with SL around 20800 for the TP of 19900.