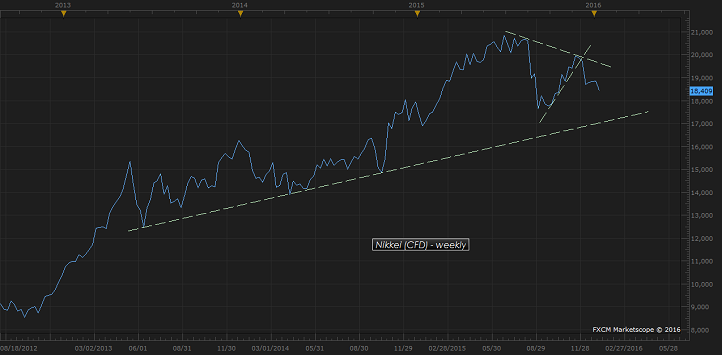

After several blockbuster year since Bank of Japan (BOJ) introduced monetary easing back in 2012, 2015 too has been a kind year for Nikkei, CFD gained more than 10%. However, 2016 may not be that great for Nikkei. After yesterday's sharp drop and strengthening of Yen, Nikkei might plunge another 1000 points in short to medium term.

Nikkei has managed to gain in 2015, though foreign investors have been net sellers. Domestic funds have taken their place. However that might not work in 2016 too. Country's pension fund, which is world's largest in late 2014 announced that it would foray into domestic equities reducing exposure to government bonds in their portfolio. As of latest data, that transformation is done.

That means GPIF, pension fund of Japan is done investing its $260 billion in stocks. Though, lower oil price should be a boost for Japan, Yen's recovery likely to erode exporters' profitability. Moreover, punitive actions form Bank of Japan (BOJ), which announced additional ETF purchase worth ¥ 300 billion only, suggests banks could stay put going ahead.

All these, along with continued slowdown in China, unlikely to bode well for stocks.

Nikkei is currently trading at 18415, down more than 10% in last six months.

Trade idea

Sell Nikkei targeting 17350 area, with stop loss around 19300.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed