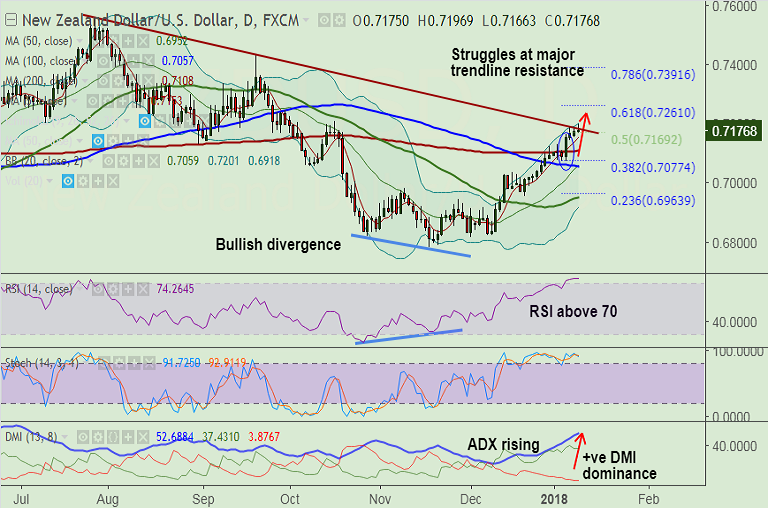

- NZD/USD has retraced break above trendline resistance at 0.7180, we see further upside only on break above.

- Technical indicators still bullish, we do not see any signs of reversal.

- That said, hourly charts have been developing a bearish divergence from price action on RSI.

- Break below immediate support at 5-DMA could see drag till 200-DMA at 0.7108.

- Violation at 200-DMA invalidates bullish bias, scope then for retrace till 20-DMA.

- On the upside, breakout at 0.7180 to see test of 0.72 handle, ahead of 0.7261 (61.8% Fib retrace of 0.7558 to 0.6780 fall).

- Fed's Williams overnight painted a benign picture of Fed rate hikes, while Fed's Bostic said that the Fed should be cautious if yield curve continues to flatten.

- Dudley's speech on Thursday will be watched for cues on the Fed's thinking.

Support levels - 0.7153 (5-DMA), 0.7108 (200-DMA), 0.7057 (100-DMA)

Resistance levels - 0.7180 (Trendline), 0.72, 0.7261 (61.8% Fib), 0.7298 (Aug 29 high)

Recommendation: Watch out for break above 0.7185 for further upside.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest