The AUD and NZD remained in a holding pattern ahead of today’s RBA statement plus US jobs report, while US interest rates fell. The US dollar index (DXY) rose by around 0.7% overnight, while NZD ranged between 0.6876 and 0.6918.

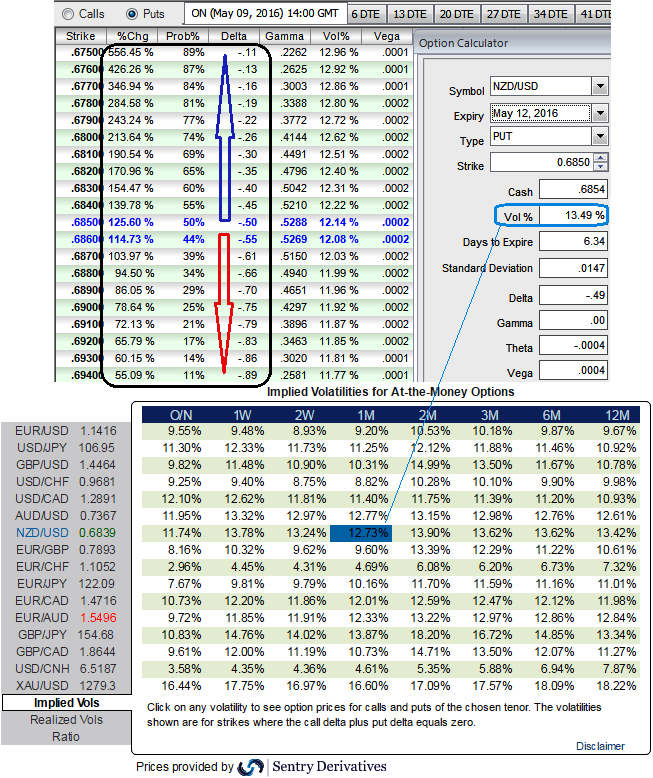

ATM IVs of 1W expiries are at 13.49% and 12.73% for 1M tenors, so it has reduced a bit, however the volatilities implied in FX option market of this pair is likely to perceive higher volatility times even after monetary policy season in both NZ and US continents which is good news for option holders.

Now, let’s glance on the sensitivity table for %change in every rise in OTM strikes and their probabilities, which means that higher chances of these strikes expiring in the money are very high.

Because, the higher volatility would mean that the option price has moved or is expected to move over a larger range in a set time period.

Subsequently, have glance on sensitivity table as well for the different rate scenarios and their probabilistic outcomes. We've just referred 0.25% OTM put strikes and their vols, it still shows 0.47 as delta values for underlying outrights with 52% of probabilities, that means 52% chances of finishing in-the-money.

Three months ahead we see markets pricing in further RBNZ easing (below 2.0%), and also pricing a greater chance of US Fed rate hikes. The NZ-US interest rate outlook thus argues for a lower NZD/USD, towards 0.6500.

As you can see the %change in option strikes and their prices, the options of ITM strikes are the most expensive. So buyers would pay the most and sellers would receive the most. Their premium is mostly made up of intrinsic value so they are relatively immune to Vega and Theta.

Vega is stagnant on either side, hence, trade an ITM option if you want to minimize the risk of Vega and Theta. They are an excellent tool when you have a strong view on the market because deep ITM options have the highest Delta. They will behave more like a position in the underlying.

On the flip side, OTM options are always the cheapest options hence buyers pay less and sellers receive less. They rely solely on extrinsic value and have a low Delta, Theta, and Vega. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Hence, OTM put options are the best suitable for those we seek long term hedging instruments for further downside risks and ITM options for short term.