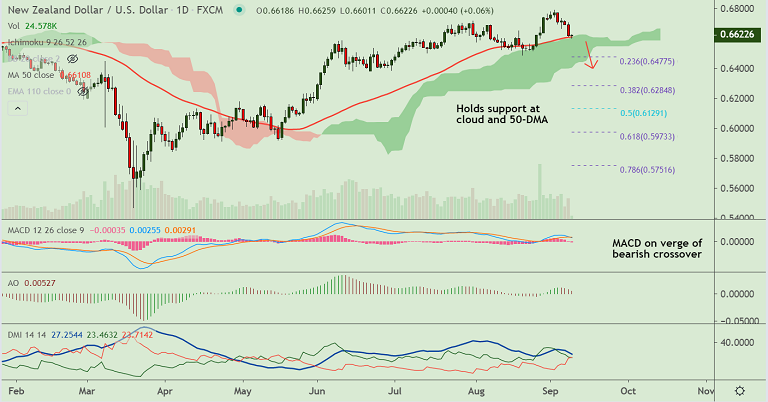

NZD/USD chart - Trading View

NZD/USD was trading with moderate gains at 02:15 GMT. The pair was trading around 0.6623, edging higher from session lows at 0.6601.

China's August CPI data released earlier today showed continuing modest inflationary pressures, supporting the antipodeans.

China matched August month’s inflation forecasts, printed at 2.4% for the year inline with the 2.4% expected and 2.7% prior.

Producer Price Index (PPI) data was expected to remain in deflationary territory, came in at -2% vs the prior reading of -2.4%/year.

NZD/USD finds major support at 0.66 level (which is nearly converged 50-DMA, cloud top and major trendline).

Major trend in the pair as evidenced by GMMA is bullish. Weakness only on decisive break below 0.66 mark.

Major Support Levels:

S1: 0.66 (nearly converged 50-DMA, cloud top and major trendline)

S2: 0.6547 (55-EMA)

S3: 0.6480 (110-EMA)

Major Resistance Levels:

R1: 0.6628 (20-DMA)

R2: 0.6646 (21-EMA)

R3: 0.6671 (5-DMA)

Summary: China inflation data cushions downside in the pair. Pullback has found strong support at 0.66 mark. Bounce off likely. Watch out for signs of upside resumption.