- RBNZ kept rates on hold at a record low of 2.25%, as widely expected, and talked down the NZD levels, while adding that the policy is likely to remain accommodative.

- The bird defied a dovish RBNZ, caught a strong knee-jerk bid and skyrocketed over 110 pips against the USD from the lows of 0.6823 to 0.6940.

- Shorts were squeezed as markets were disappointed with no clear guidance from the central bank for a June rate cut.

- Subsequently NZD/USD pared nearly half the RBNZ-led rally, but has resumed upside to trade around session highs at 0.6932.

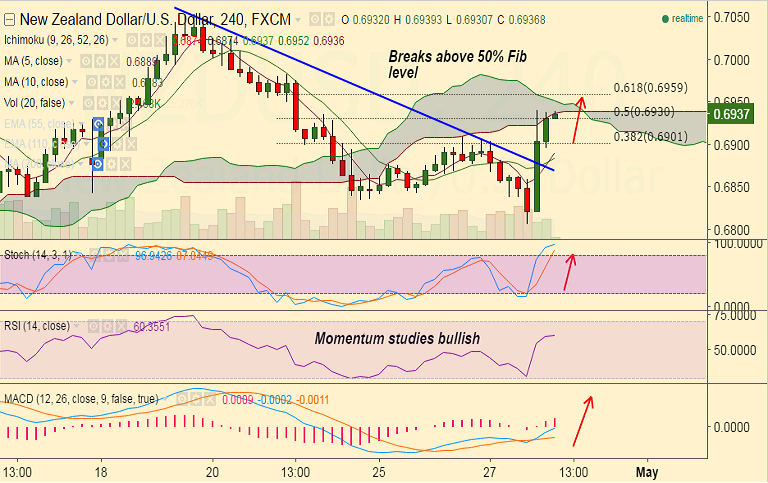

- 0.6930 is 50% Fib retrace of 0.7053 to 0.6807 fall, a strong resistance level. Clear break above will see next hurdle at 0.6952 and the 0.6960 (61.8% Fib).

- The pair has broken strong trendline resistance at 0.6980 and weakness only below trendline now turned support.

- Markets will now assess today’s RBNZ policy statement ahead of the US advance GDP numbers due later in the NY session.

Recommendation: Good to long dips around 0.6930, SL: 0.69, TP: 0.6960/0.6980/0.70