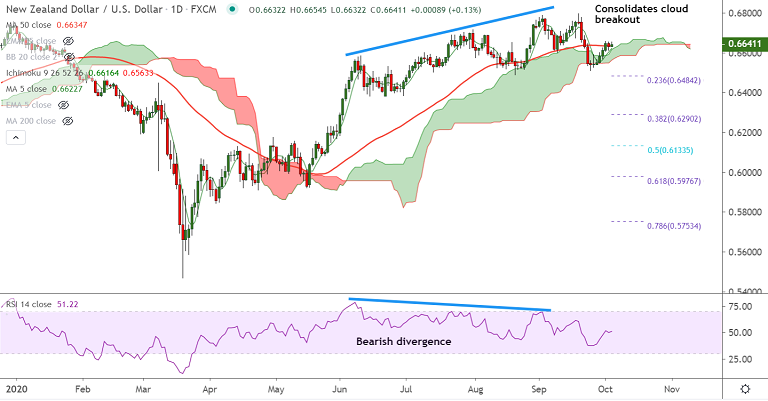

NZD/USD chart - Trading View

Technical Analysis: Bias Neutral

GMMA Indicator

- Neutral bias on the GMMA for minor and major trend on the daily and weekly charts

Ichimoku Analysis

- Price action is above cloud on the weekly and daily charts

- Chikou Span has gone flat as price action consolidates above daily cloud

- Daily Tenkan Sen: 0.6584

- Daily Kijun Sen: 0.6654

Oscillators

- RSI is flat, just above the 50 mark, while stochs are biased higher

- Momentum has turned bearish on the weekly charts after upside was rejected at 200W MA resistance

Bollinger Bands

- Bollinger bands are wide suggesting high volatility

Major Support Levels: 0.6604 (55-EMA), 0.6525 (110-EMA)

Major Resistance Levels: 0.6642 (20-DMA), 0.6774 (200W MA)

Summary: NZD/USD is expected to trade in the 0.6525-0.6775 range in the near term. Decisive breakout at 200W MA will buoy prices higher. Focus on FOMC minutes due this Wednesday for further impetus.