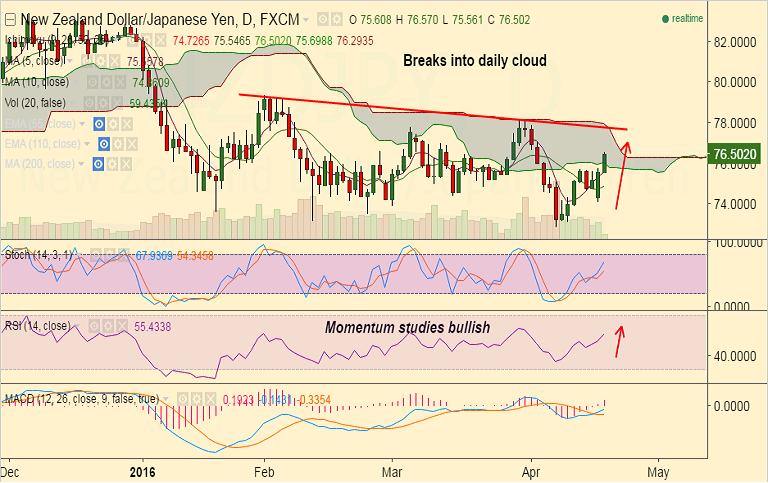

- NZD/JPY price action has broken into the daily cloud, raising scope for test of trendline at 77.75.

- Techs are supportive for further upside, pair holds above 5-DMA after closing above on Monday's trade.

- Next hurdle on the upside located at 77 ahead of 77.44 (Mar 7th highs) and then 77.75 (trendline).

- Kiwi caught fresh bid-wave after the oil prices halted the overnight retreat and swung back into gains, providing fresh impetus to resource-linked NZD.

- On the other side Japan’s nationwide departmental store sales tumbled 2.9 pct y/y, from up 0.2 pct in February.

- BoJ will hold its two day monetary policy meeting on 27-28 April where it is expected to decide policy rate and update forecasts inflation and growth figures.

- Reuters poll shows 8 out of 16 analysts feel that the BOJ will take easing steps at 27-28 April meeting.

- Focus now remains on the latest fortnightly Fonterra’s dairy auction results - Global Dairy Trade (GDT) price index.

Recommendation: Good to buy dips around 76.35/40, SL: 75.55, TP: 77/77.45/77.75