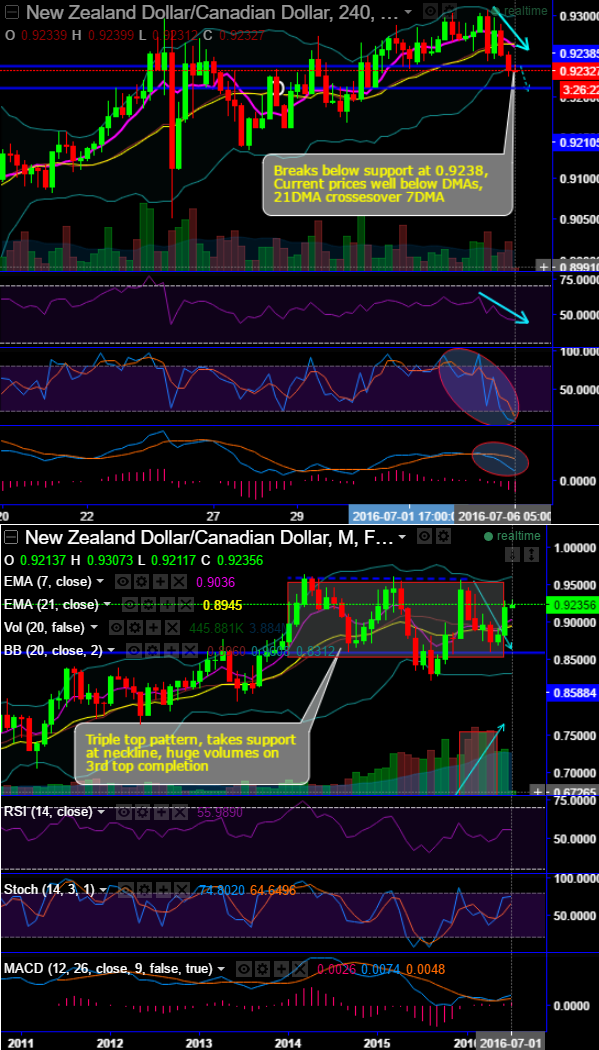

After the pair breaks below support at 0.9238, the current prices well below DMAs, 21DMA crosses-over 7DMA.

Major resistance is now seen at 0.9265 (21DMA).

Earlier, the pair has bounced up to 0.9307 levels (upper BB) while articulating and began declining from that level to currently trade around 0.9235 levels.

We foresee the short term bearish trend for sure for next strong support at 0.9210 level as the leading indicators are clearly converging to the on-going dips that confirm the momentum in selling.

On a broader perspective, we also spotted out the triple top formation on monthly charts (see dotted lines) where it has taken support at 0.8588 levels. During the completion of 3rd top pattern, we can also observe mammoth volumes which are in confirming the bears interest in this pair.

On the lower side, upon the breach below 0.9238 we see more southward targets up to 0.9210.

As a result, we conclude stating that it is advisable to short rallies using binary options tunnel spread which is a binary version of bear put spreads for the targets of 0.9210.